The famous investor David Dreman, who Kiplinger once referred to as the “consummate contrarian”, follows a strategy which capitalizes on the emotional, knee-jerk reactions that make unpopular stocks underpriced, writes Validea CEO John Reese in TheStreet.

This is no coincidence, given Dreman’s knowledge and experience in the area of behavioral finance. Dreman identifies such undervalued companies, Reese explains, by comparing their share prices to four different financial variables that gauge the strength of the underlying business: earnings, cash flow, book value and dividend yield. Reese describes the findings of studies conducted by Dreman from 1970 to 1996 and elaborates on the metrics measured.

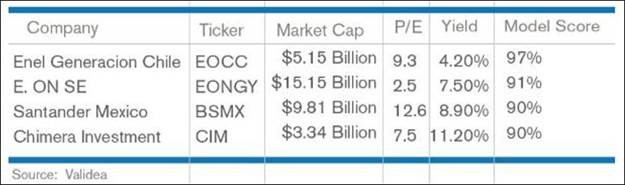

He also highlights the strong performance of Validea’s Dreman-based model portfolio in 2016 (after a few challenging years), evidenced by returns of 25.7% versus the S&P 500’s 9.5% gains. Using his Dreman-inspired stock screening model, Reese identifies the following high-scoring picks: