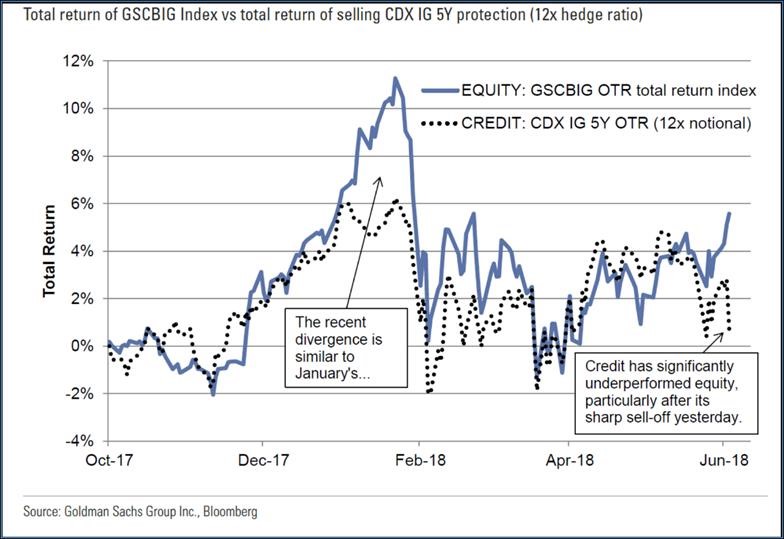

Strategists at Goldman Sachs say that U.S. investment-grade debt has trailed equities for a month and has been “behaving in a way that portended the last big equity shakeup,” according to a recent article in Bloomberg.

Similar to earlier in the year, credit has trailed equity (when measured relative to volatility) while tech stocks have set records. In a recent note, the strategists wrote, “In early January, modest widening in credit contrasted sharply with a rapid rise in equity prices. That implied that credit (accurately) did not buy into the enthusiasm of the equity market.”

According to calculations of Goldman strategist John Marshall, when credit has trailed equity by 1 standard deviation over periods of two, four, six and eight weeks, stocks dipped (on average) by 2.3 percent over the next month. On the flip side, when credit outperformed stocks over the same periods, equities rose by about 2.4 percent in the next month. Marshall wrote, “We see this divergence as significant and leads us to favor de-risking strategies in equities.”