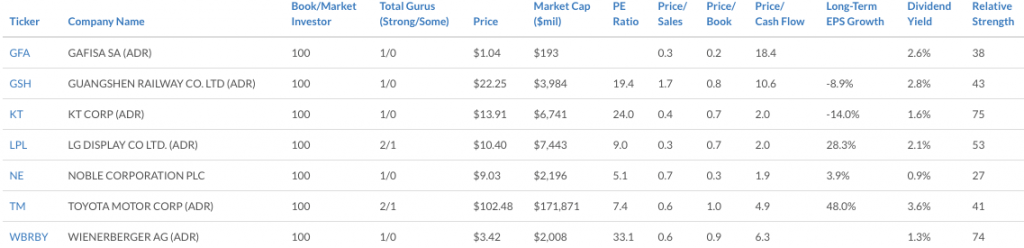

This week, we bring you the Stock Screen of the week from Validea. On Validea.com, you can screen for stocks using the site’s Guru Stock Screener, which scores stocks based on the fundamental stock selection criteria of legendary investors. The firm’s models are based on investing legends such as Warren Buffett, Peter Lynch, Benjamin Graham, Kenneth Fisher, Martin Zweig, David Dreman, Joel Greenblatt and others.

This week’s screen is based on Validea’s Joseph Piotroski-based strategy, which looks for stocks trading with a strong book/market ratio and high return on assets. The model’s criteria are listed below.

- Book/Market Ratio

- Return on Assets

- Change in Return on Assets

- Cash Flow from Operations

- Cash Compared to Net Income

- Change in Long Term Debt/Assets

- Change in Current Ratio

- Change in Shares Outstanding

- Change in Gross Margin

- Change in Asset Turnover

Piotroski is a little-known college accounting professor who back in 2000 wrote a research paper showing how using simple accounting-based stock-selection methods could produce excellent returns over the long haul. His back-tested results doubled the S&P 500 over a two-decade period.

Piotroski targeted stocks with book/market ratios in the top 20% of the market. If you’re concerned about inflation, stocks passing the Piotroski method may well be a good place to look because the Piotroski-based criteria line up with many of Warren Buffett’s inflation-beating criteria such as: Asset turnover should be greater in the most recent year than it was a year earlier; gross margin should also be higher; and the long-term debt/assets ratio should be lower. Among the other qualities he looked for were increasing returns on assets and current ratios, and a positive cash flow from operations.

All of the stocks below meet 100% of the criteria listed above. To eliminate companies with particularly small market caps, we limited the screen to those companies with market caps greater than $150 million.