Proactive Advisor recently published part of a white paper authored by active money manager Flexible Plan Investments regarding what it terms the “gold debate”—a “broad overview of the tangible benefits of portfolio diversification with gold, and some eye-opening data suggesting a much more important role for gold in portfolios that seek optimal risk-adjusted returns.”

The article offers arguments in favor of including gold in an investment portfolio, including using it as a:

- Hedge against inflation and deflation;

- Protection against a declining U.S. dollar;

- A “long-proven store of historical value”

- An important portfolio diversifier.

It notes the range of “highly polarized” opinions on gold as a portfolio component, arguing the importance of understanding the “economic and market drivers that can make gold a valuable constituent” on an investment portfolio.

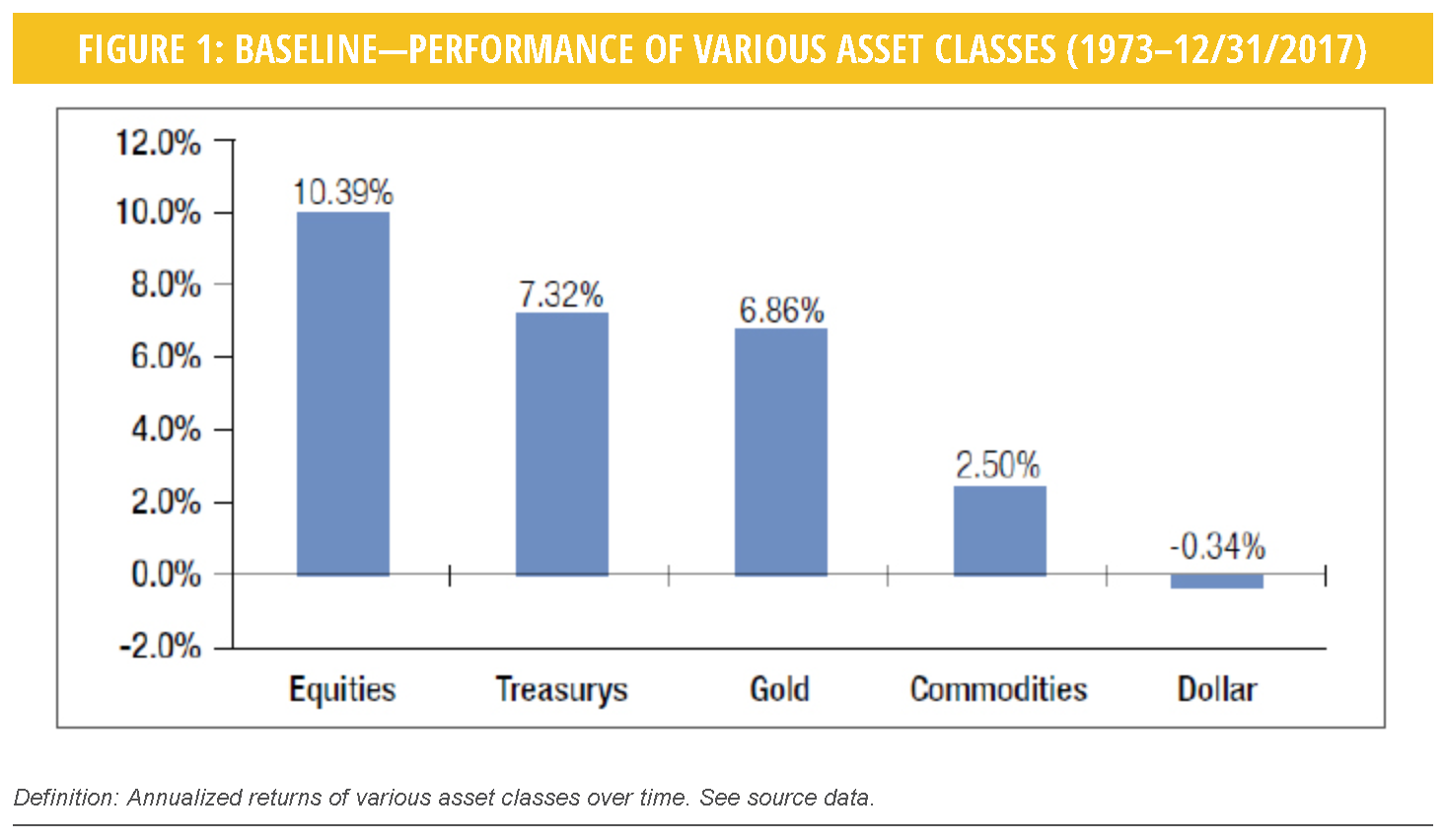

As part of this analysis, the paper offers the following chart outlining the performance of gold relative to other asset classes:

Although gold has had a much “bumpier” journey than equities over the past several decades, the paper points out how it has “demonstrated the ability to outperform equities in times of equity market stress and bonds under a variety of different economic conditions.”

The paper provides a detailed examination of the relative performance of gold based on historical data from 1973 through 2017 under the following seven market scenarios:

- Real returns on the 10-year Treasury are negative;

- Equities are in a bear market;

- Commodity prices are in a bull market’

- U.S. dollar is in a bear market;

- U.S. Treasury bonds are in a bear market;

- Inflation is rising;

- Market volatility is high.

The editor’s note at the close of the article states: “It is clear from the examples given here that gold can provide favorable returns and act as an important counterbalancing portfolio component under a variety of very specific market and economic conditions.”