Although the global purchase of negative-yielding bonds—which has reached nearly $17 trillion–may seem like a losing proposition, a recent Bloomberg article outlines three ways that these securities can be traded for a profit:

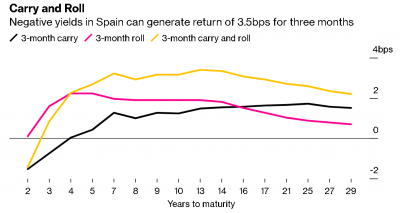

Carry and Roll, which involved borrowing over a short time period and buying bonds with longer maturities where yields are typically higher. The “carry” is the coupon of the purchased bond and the “roll” is the capital appreciation that can be earned as it “slides down the yield curve toward maturity.” The article offers the following example:

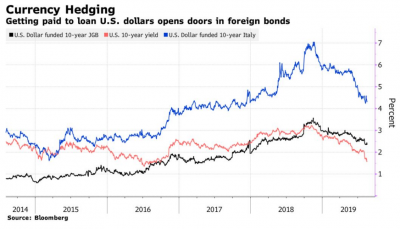

Currency hedging, where investors take advantage of the rising demand for dollars to generate positive returns from sub-zero yields in Europe and Japan. The following chart uses the example of Italian debt:

Focus on the shape of the yield curve: “A steeper one creates the opportunity to borrow in the short term and invest in longer maturities,” the article explains, using the example of Japan:

The article concludes, “The flattening of the U.S. curve may end up sending funds to a number of other markets that offer a steeper alternative — just one of the ways traders are looking to get creative as the amount of negative-yielding debt swells to new records.”