In a recent MarketWatch article, Mark Hulbert presents a market-timing indicator that “has a better historical track record than the cyclically adjusted price to earnings ratio” made famous by Nobel Laureate Robert Schiller.

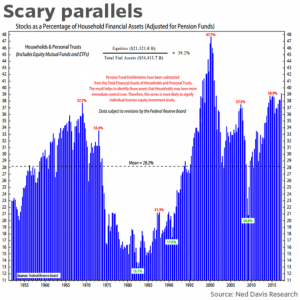

The indicator, he writes, is the “average portfolio allocation that U.S. households have to equities,” which has reached its current level five other times since the 1980s.” Four of those times, Hulbert asserts, “came right before major stock market tops.”

Hulbert reports that, according to recent data from the Federal Reserve, U.S. households have 39.2% of their financial assets in equities. In 2015, it was 38.9% and, in May of that year, he says, a bear market began (based on the Ned David bear market calendar) and ended the subsequent February.