In a recent article for The Wall Street Journal, MarketWatch senior columnist Mark Hulbert argues that the “annual performance rankings of funds or investment newsletters that appear every January are a siren song, tempting us with the prospect of mouthwatering gains but often leading us to financial pain.”

Hulbert supports his case using Morningstar data that shows, if you had invested one year ago in the top-ranking fund (2017 calendar-year returns of 68.9%), you would have lost 6.9% in 2018 (versus the S&P 500 loss of 4.4%). While Hulbert points out that the outcomes are not always so dramatic, a similar trend happens “more often than not.”

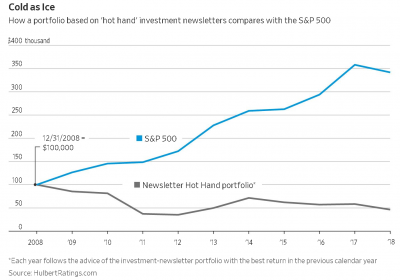

“The perils of chasing one-year returns are also illustrated by the performance of top-rated investment newsletters,” Hulbert says, offering the following supporting data:

Hulbert cites several factors that contribute to this “reversal of fortunes:”

- One-year returns are based primarily on luck, and a fund is unlikely to be lucky two years in a row;

- “A given year’s top performer is likely to be riskier than average, so managers who are unlucky in the second year will likely end up performing poorly;”

- Chances are that many of the securities owned by a year’s top performer are overvalued. Hulbert cites a study by Research Affiliates showing that those stocks in each industry sector with the largest market caps–at the beginning of each calendar year between 1952 and 2011—lagged behind the other stocks in their sectors by an 4.2% (on average).

- Research shows that the “momentum effect” in a given year typically lasts for only two to six more months (study by Newfound Research), after which the previous year’s best performers “tend to revert toward the mean and then do no better than random;”

- The month of January usually experiences the opposite of momentum, “with the previous year’s worst performers tending to outperform the previous year’s best.”