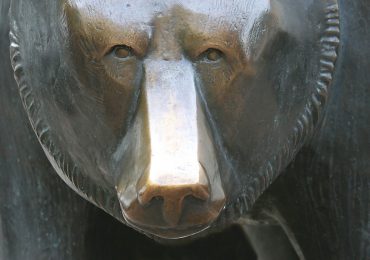

A recent article by Jeff Sommer of The New York Times poses the question: “Is this the top of the market? Is it time to sell?”

“Simply put,” writes Sommer, “my answer is this: If you’re a stock investor, be prepared for a major decline, not because one is necessarily coming soon but because no one can predict where the markets are heading.” The article points out that the current economic expansion is the third longest since 1854, and that the low volatility has been “almost supernatural.”

Regarding the risk of a decline, Sommer offers comments by Vanguard principal Fran Kinniry who asserts, “If you realize that you can’t afford to risk any losses, you shouldn’t be investing in stocks at all and this is a great time to sell. It’s as simple as that.”

Mr. Kinniry also emphasizes that the huge gains in the market could be responsible for “portfolio drift,” a situation in which investors hold much more stock that intended. “If you have not looked at your portfolio for a long time,” he told Sommer, “the chances are very high that you should rebalance,” and return to a mix of assets more closely aligned with your risk profile.

Sommer underscores how behavioral considerations are an important factor. In significant market downturns, writes Sommer, “many people desperately want to sell stocks, or suddenly realize that they must sell because they need the cash.” Kinniry advises, “Be capable of sticking with your strategy in the best of times and the worst of times. It’s much easier to think clearly now than in the middle of a big market downturn.”