Investors who may be sitting on cash due to nerves about high valuations, rising interest rates and market volatility might be missing out on huge gains, according to Bloomberg columnist Ben Carlson.

Carlson outlines three options for putting cash to work in today’s market:

- Invest a lump sum and take what the market gives you.

- Wait for the market to fall further and invest at a better entry point.

- Dollar cost average into the market to spread your risks.

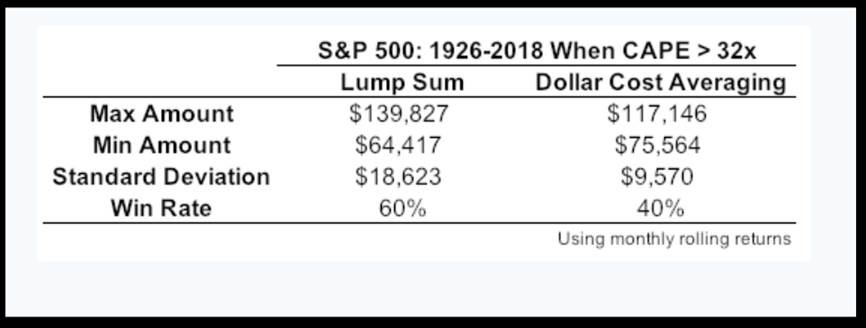

The third option “offers the biggest payoff from both a psychological and a market perspective,” Carlson argues, even though the lump-sum option has the highest probability of success—he cites research from Vanguard showing that a lump-sum approach on average beats dollar cost averaging about two-thirds of the time but argues that such analysis overlooks the market’s current valuation.

The current CAPE ratio, Carlson writes, “stands at roughly 32 times the previous 10 years’ average real earnings, a level only reached before the 1929 crash and in the late 1990s when the dot-com bubble popped.” In today’s climate, he adds, dollar cost averaging is the better tack, especially in light of the market crashes that occurred in both of the latter examples.

Under both of the above strategies, Carlson says, “there were losses in about 40 percent of all 12-month periods, though the losses were much larger under the lump-sum option.”

Carlson concludes, “Investing is ultimately an exercise in regret minimization. Investors need to ask themselves what they would regret more—missing out on further gains in the market or taking part in large losses? Investing all of your cash at once gives you a higher probability of taking part in larger gains but also taking part in larger losses.”