A study conducted by Morningstar, summarized in a recent article by the firm’s Alex Bryan, CFA, attempts to determine whether investors can duplicate strategic-beta fund performance with a combination of market cap-weighted indexes.

The study compares the performance of a group of strategic beta funds to a “replicating portfolio of six style benchmarks for its relevant universe.” The purpose of the study, writes Bryan, is not necessarily to suggest that investors should replace strategic beta funds, but rather to offer insight as to whether they “provide exposure that’s distinctive from a combination of various cap-weighted indexes.”

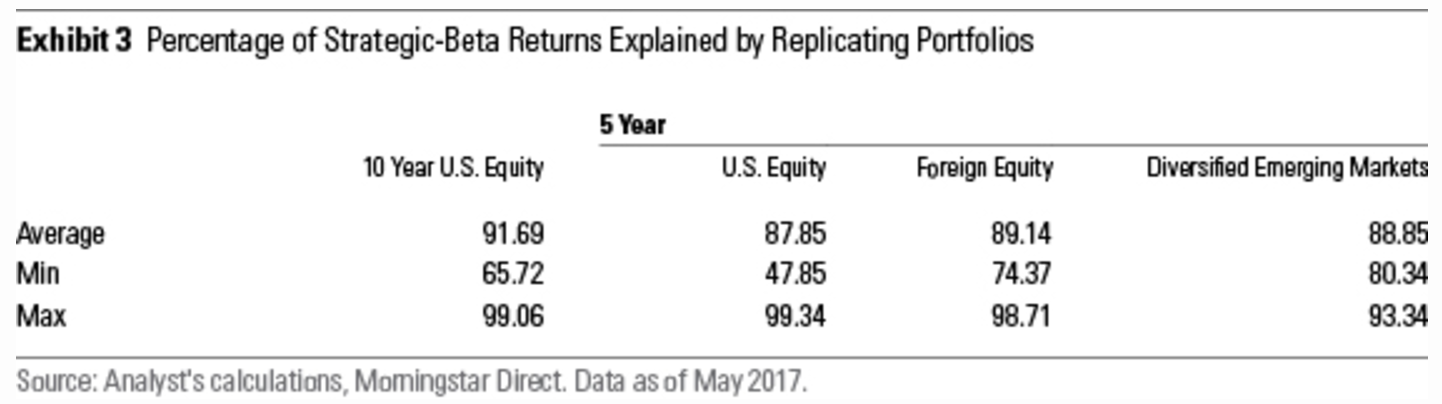

According to the article, study data showed that “the replicating portfolios fit the return patterns of the strategic-beta funds well” and that, “on average, the replicating portfolios explained 92% of the return variance of the U.S strategic-beta funds during the trailing 10 years through May 2017.”

According to the article, “strategic-beta funds tend to be more expensive than traditional market-cap-weighted alternatives and are often presented as a better way to invest. But this study suggests that strategic-beta funds aren’t as distinctive as advertised. Most of these funds just repackage market risk, along with size and value exposures that simple cap-weighted indexes can offer.”