In his latest market commentary, Jim O’Shaughnessy writes that the market is seeing a major flip-flop in leadership similar to what often occurs at the end of recessions, and says that, despite the recent run-up, it’s still a good time to buy stocks.

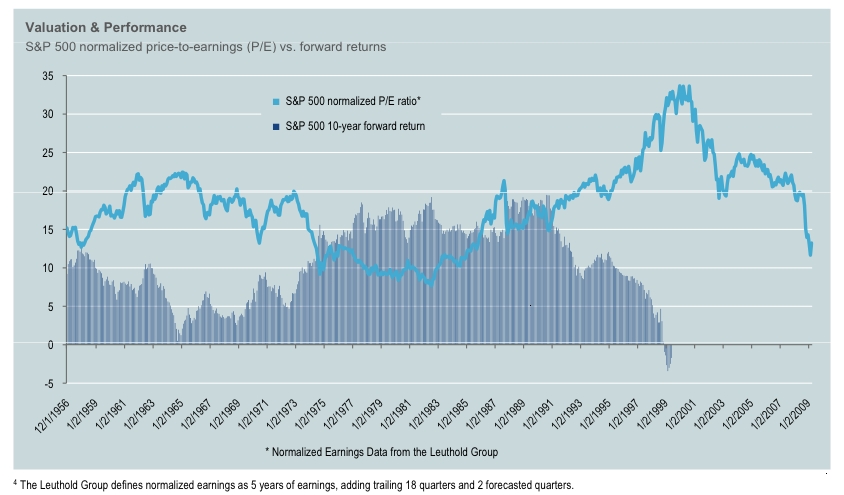

“While many of the once-in-a-lifetime bargains are gone, stocks still look attractively valued,” O’Shaughnessy writes on his asset management Web site. He cites the normalized price/earnings ratio of the S&P 500 (a measure that uses five years worth of earnings — 18 quarters of historical data plus two forecasted quarters) as evidence. When normalized P/Es are low, returns over the next decade tend to be high, and vice versa.

“After the rebound,” O’Shaughnessy writes, “normalized P/E remains significantly below its long-term median. The market will likely remain cheap as earnings recover from the massive losses of 2008. In addition, 15% of the index is still trading below liquidation value. … Despite the strong bounce back since March, we continue to believe that over the next three, five, and ten years, equities will be the best performing asset class and that investors need to take the opportunity the market has given them.”

Since the March 9 low, O’Shaughnessy says, stocks in the top decile of the market based on momentum have returned 15.7%, while stocks in the lowest decile based on momentum have returned a whopping 145.3%. “The worse a stock’s return was in the six months leading up to the March 9 bottom, the better it has been in the recovery — with a remarkable degree of consistency,” O’Shaughnessy writes. That’s a big reversal of the trend that had held for much of 2007 and all of 2008, when momentum trounced value.

Similarly, stocks with the highest price/sales ratios were hit much less hard than stocks with the highest price/sales ratios last fall. But since March 9, the best decile of P/S stocks has returned 112.0%, while the worst decile has returned 32.1%, O’Shaughnessy says. “The rebound has been largely driven by companies which the market had priced for extinction,” he adds.

The value resurgence is paying off for O’Shaughnessy, who was scooping up value stocks in recent months when others were fearing financial Armageddon. He says he thinks cheap stocks will continue to outperform, but he also warns investors against dumping good momentum strategies. “The best time to invest (or stay invested) in a strategy is when others are fearful that it is broken,” he says.