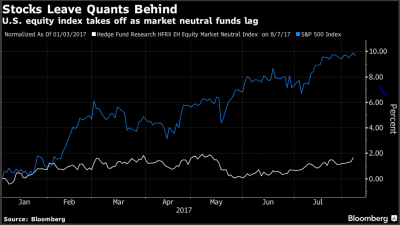

Decreased returns from computerized investment strategies (“quant” funds) suggest that the robo revolution could be slowing down, according to a recent Bloomberg article.

According to Eagle’s View Asset Management founder Neal Berger, the article says, quant fund returns have been losing ground for a year, “suggesting the rest of the market has figured out what the robots are doing and started taking evasive action.”

According to Fred Branovan of FFC Capital Corp., “market neutral funds need volatility to do well, and the daily increases in the equity markets make it very hard to short in this environment,” adding that most quant funds are not performing well.

While the article says that there are funds showing strong performance, Berger says that “pedestrian” quant strategies or factor investing “won’t survive.” He argues that quant funds need to exploit market inefficiencies to be successful, that they’re “waiting for the sucker to come to the table, but the suckers are fewer and far between.”