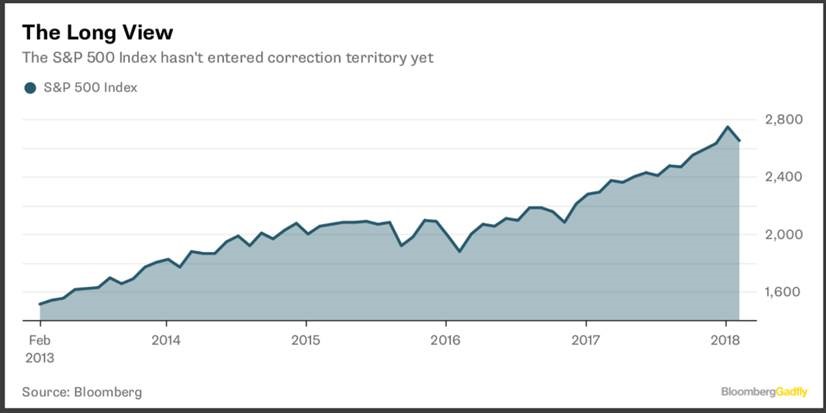

Bulls should be “as confident as ever,” writes columnist Nir Kaissar in a recent Bloomberg article.

Emphasizing that “panicking is never a good plan when it comes to investing,” Kaissar writes, “but it’s particularly silly now, because nothing truly eventful has happened yet.”

The economy continues to grow, he writes, and the market’s full valuations are supported by corporate earnings expectations as well as low interest rates. The recent sell-off, he adds, will “undoubtedly make the Federal Reserve think twice about is plans to raise rates.”

Kaissar underscores the lofty CAPE of U.S. stocks which stood at 32 even after the market’s recent dips (data provided by Yale professor Robert Shiller). “That’s still nearly double the long-term average of 16.8 since 1881,” he adds, noting that the S&P 500 would have to drop by 52 percent to reach its long-term average valuation.

The article concludes with Kaissar’s suggestion that we all take “a collective deep breath. Investors who weren’t worried a week ago have nothing to worry about now. And for those who were, there’s nothing remotely interesting to see yet.”