In this episode, we walk through our experience of launching a small-cap value ETF in 2014, running it for 6 years and then shutting it down in 2020. We look…

Tag: ETFs

Breaking Down Popular Value ETFs | The Portfolio Construction Choices that Define Them

There is a tendency for investors to think that all value strategies are similar. But the reality is they can be very different. In this episode, we work through the…

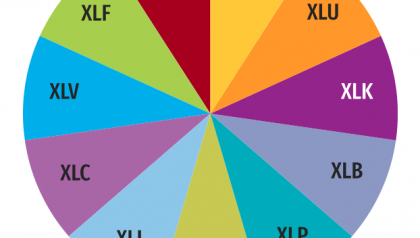

Investing In Sectors: A Look at the 11 Sector ETFs

By Justin Carbonneau (Twitter | LinkedIn | YouTube) — There are eleven sectors (Energy, Health Care, Consumer Staples, Technology, Consumer Discretionary, Industrials, Communication, Services, Financials, Real Estate, Utilities, and Materials) that make up the…

Before Buying This ETF, Read The Ingredients

What measure to use to determine what’s a value stock and what’s a growth stock is an ongoing debate, and especially relevant now, when Microsoft—typically not considered a value stock—is…

Rebalancing At Momentum ETF Offers Clues To Beat Market

Late last month, the iShares MSCI USA Momentum Factor ETF, which offers maximum exposure to the momentum factor, was rebalanced, offering clues to market-beating strategies, contends Ryan Jackson, a Manager…

In Spite of Losses, ARK Fund Tops $300m in Fees

Though it’s lost nearly $10 billion of investors’s money, the flagship ETF from Cathie Wood’s Ark Investment Management has garnered over $300 million in fees since it launched 9 years…

Building an Inflation Fighting Portfolio With Dave Schassler

With inflation returning after being dormant for decades, many investors have had a renewed interest in adding inflation fighting assets to their portfolios. But figuring out how to do that…

The (Risk-Adjusted) Returns Come Out at Night with Bruce Lavine

You might think that the return profile of the market looks similar during the day and overnight. But research has shown that isn’t the case. In this episode, we discuss…

ETFs Transformed Asset Management

ETFs were first launched 30 years ago and were mainly in the domain of institutional money managers, a relatively humble beginning compared to where the ETF market is now, contends…

30 Years Ago The First ETF Launched

30 years ago, the SPDR S&P 500 ETF Trust, the first of its kind, launched and revolutionized investing by allowing investors to buy and sells stocks via one publicly-traded share—the…