Benjamin Graham (1894-1976) is considered the father of value investing and one of the most influential figures in investment history. His teachings and writings, especially his books Security Analysis (1934)…

Tag: Factor Focus

Beyond Dividend Yield: The Power of Shareholder Yield

In the world of investing, investors are always on the lookout for metrics that can help them identify undervalued companies with the potential for strong returns. One such metric that…

Twin Momentum: Combining Price and Fundamental Momentum

Twin Momentum is a unique investing approach that combines two powerful momentum factors to identify stocks with strong potential for outperformance. Validea’s Twin Momentum strategy is based on the research…

The Quality Factor: Benefits of Investing in High Quality Stocks

When it comes to investing in the stock market, there are many different strategies and factors to consider. One approach that has gained popularity in recent years is focusing on…

The Investment Strategy of Peter Lynch

Peter Lynch is considered one of the greatest investors of all time. As the manager of the Magellan Fund at Fidelity Investments from 1977 to 1990, Lynch averaged a 29.2%…

The Enduring Appeal of Dividend Aristocrats

In the realm of investing, Dividend Aristocrats hold a special place. These are companies not just known for their robust financial health but also for their exceptional commitment to returning…

Eight Fundamental Reasons Warren Buffett Should Still Like Apple

For billionaire investor Warren Buffett, one stock has continued to play a pivotal role in his investment strategy over the years. It has also become his largest position by a…

Optimism vs. Pessimism: Defining Your Investing Future

By Justin Carbonneau (Twitter | LinkedIn | YouTube) — Optimism is defined as the “hopefulness and confidence about the future or the successful outcome of something.” Pessimism is defined as “a tendency to see…

Why It’s Great to be an Investor Now in 2023

By Justin Carbonneau (Twitter | LinkedIn | YouTube) — This may seem like a strange headline given the path of stocks over the past two years. Many equity investors, particularly in the small-cap space,…

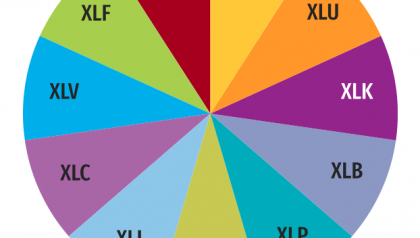

Investing In Sectors: A Look at the 11 Sector ETFs

By Justin Carbonneau (Twitter | LinkedIn | YouTube) — There are eleven sectors (Energy, Health Care, Consumer Staples, Technology, Consumer Discretionary, Industrials, Communication, Services, Financials, Real Estate, Utilities, and Materials) that make up the…