A recent article in Forbes offers perspective on bear market rallies and why they occur, drawing on historical data going back to the 1930’s.

“One question I often get from my articles about bear markets is why bear market rallies occur at all?” it says, adding, “That is, what makes them an essential part of the bull-bear stock market cycle.”

The author explains: “In my observations, the key function of a bear market rally is to change investor sentiment, convincing them they should no longer fear a further decline. This briefly injects capital into the market, raising stock prices sufficiently enough for a wave of selling to take place, leading to further decline.”

Through a series of charts, the author illustrates a comparative analysis of share price and investor sentiment for both the 2007-2008 and the 2000-2002 periods. He uses daily S&P 500 data (from weekly AAII surveys) to label “various highs and lows with the percentage of investors that reported being bullish that week,” which are labeled “Bullish%.”

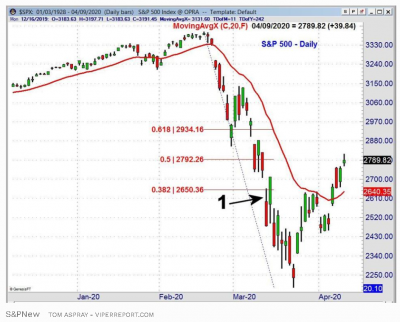

The article then extends the discussion to recent trends in both areas with respect to price resistance (where selling at a certain price level prevents a stock from exceeding that price) and retracement (temporary movement in the opposite direction of a current trend in price):

The author notes, “though the fear in the market was at panic levels in the first few weeks of March, the Bullish% had a low of 29.7% the week of March 12 (point 1). Having watched these numbers for decades, I expected to see the Bullish% to drop to the 20% level or lower to match the market’s decline. The highest Bullish% reading so far this year has been 45.6%, which occurred the week of January 23.”

The article concludes by comparing recent movements to the March 2009 market bottom in which the Bullish% experienced a low of 18.9% before the bear market ended. “So far,” the article points out, “we have not seen the very low Bullish% readings that typically accompany a market bottom,” adding, “As the past bear market examples have shown, bear market rallies often last much longer. “