At the end of the Super Bowl, a jubilant Tom Brady attributed the Patriot’s win to the “mental toughness” the team had demonstrated all year–which, no doubt, came in handy when they entered the fourth quarter trailing the Falcons by ten points.

Unless we’re talking about basis points, things would be pretty dismal for any investor entering the fourth quarter down by ten. But the idea of mental toughness applies to investing as well as to football, whether it be for a day, month, quarter or, for that matter, a year.

Value investing is a perfect example of this. We know, based on research from Fama and French, that buying low valuation stocks can reap rewards over long periods of time. It is important to understand, however, that this strategy doesn’t work all the time. Value stocks can go through lengthy periods of underperformance, and the investor with the mental toughness to stick with the strategy stands the best chance of coming out a winner.

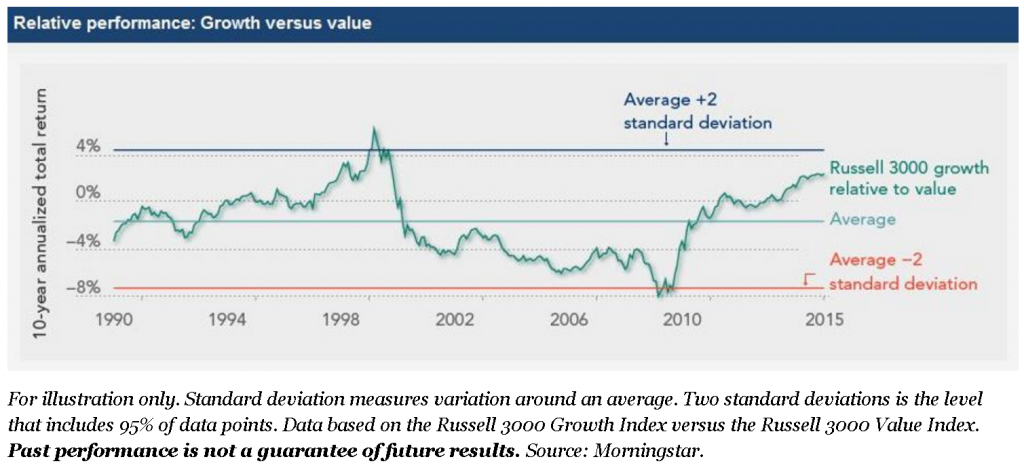

The following graph shows the relative performance of growth and value stocks and reflects the cyclicality of their relative performance. Historically, growth stocks have often outperformed for extended periods, but value eventually rebounded and over most long periods of time value wins out. In the chart below, when the green line, which represents the Russell 3000 growth relative to value performance, is rising these are periods when growth is outpacing value (i.e. late 90s). When the green line is falling and below the average, value is winning. From around 2010 to the end of 2015, growth stocks had a long run over their value counterparts, and many investors buying low priced value stocks saw there portfolios lag most major indices and portfolios with a growth stock bias. It was a tough 5 years to be a disciplined value investor.

The Super Bowl, in fact, can be viewed as a microcosm of the investing world. Tom Brady and the New England Patriots have an impressive, long- term track record. During the first half of this year’s game, however, the Atlanta Falcons played outstanding football while the Patriots performed poorly. But the Patriots kept their head in the game and remained focused on their strategy while filtering out the stadium noise. As a result, despite trailing the Falcons heading into the fourth quarter, the Patriots rebounded all the way to victory.

Sean Gavin, portfolio manager of Fidelity Value Discovery Fund, was quoted in a 2016 Forbes article as saying, “At times, value investors have to ride out periods of underperformance but, over the long term, value strategies have proven their ability to deliver performance for investors.” While growth had been outperforming for years, the tables turned in 2016 and value stocks became the winners. In 2017 so far, growth is on top again but a long term value stock reversion is more likely than not given the performance of value vs. growth over the last few years.

According to Ben Johnson, co-author of the book Strategic Value Investing, “Successful value investing requires independent thought and going against the herd.” That means tuning out the stadium noise and staying true to your strategy, even when things aren’t going exactly the way you’d like them to in the near term.

It’s not surprising that Johnson’s book ended up on Warren Buffett’s reading list for both the 2015 and 2016 Berkshire Hathaway annual meetings. Buffett, like Brady, is a legend in his game. By keeping a level head and sticking to his mantra of investing in fundamentally sound businesses at good prices, Buffett’s been winning at the investing game for a very long time. A big factor in his success, however, is patience.

“No matter how great the talent or efforts,” Buffett says, “some things just take time.”