Mukesh Ambani, the 64-year-old Indian tycoon who controls Reliance Industries Ltd. and a $208 billion empire, is beginning to make plans for succession, details a profile in Bloomberg. According to anonymous sources close to the family, Ambani is taking a page from the Walton Family playbook, in an effort to avoid the pitfalls that tore apart him and his brother when his father died.

Ambani is considering transferring his family’s holdings into a trust-esque structure with control of his flagship Reliance Industries Ltd, with himself, his wife Nita, and their three children maintaining stakes in and remaining on the board of the new entity. However, management of the day-to-day operations will be given to outsiders. The Waltons, the world’s richest family, handled succession in similar fashion when they outsourced the U.S. retail operations in 1988 and only retained board-level oversight.

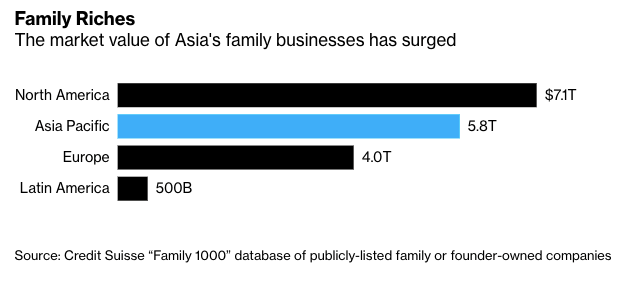

There is almost $1.3 trillion set to change hands between Asia’s first generation of tycoons and their heirs over the next 10 years, Bloomberg contends. Ambani is no stranger to the potential pitfalls of succession. When his father died in 2002 without a will, Ambani and his brother Anil worked together at first, but eventually their mother had to intervene after too many disputes. In 2005, they divided Reliance’s assets, with Ambani retaining control over the textiles, petrochemicals, refining, oil and gas operations. In the nearly 2 decades since, Ambani has quadrupled Reliance’s market value, making it the most valuable company in India.

So it’s little wonder that he is planning now to prepare for a continued healthy future of the company. Sources say that Nita and their children would have equal shares in the holding firm, in an effort to prevent uncertainty over control that could lead to the kind of infighting that befell Ambani and his brother. But Ambani is not the only family looking to plan ahead: Jan Boes, the Singapore-based head of a UBS Global Wealth Management division tells Bloomberg that client inquiries have doubled since the pandemic. More than a third of the family empires in Asia are still owned by first-generation founders, and it’s likely they will take inspiration from the Ambani family as they make their moves.