Tech companies have built up their businesses over the last two years, spending enormous amounts of capital in anticipation of greater post-pandemic demand. But that demand has failed to materialize, and now that those companies are on the hook for that capital, investors aren’t the only ones who will feel the pain, contends an article in Barron’s. More workers will be laid off, consumers will have to pay more for products and services they’ve incorporated into their lives for years, and share prices will fall even further than they already have.

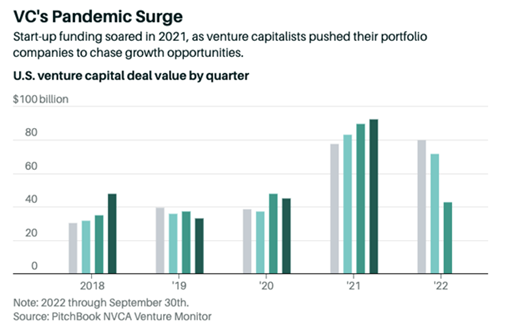

Driven by government stimulus money, low interest rates, and high demand during the pandemic, venture capitalists poured funds into tech companies, who in turn hired in droves in order to meet the anticipated demand. Now, many of those companies have had to admit that they overbuilt. “Ultimately, placing this bet was my call to make and I got this wrong,” said Tobi Lütke, the CEO of Shopify, ahead of layoffs last summer. His wasn’t the only concession; Amazon announced plans to pull back and raise fees for its streaming service, as did Walt Disney, Apple and Netflix. There isn’t a corner of the tech sector that hasn’t declined, driven downward by the impact of higher interest rates on future growth. Mega-cap tech giants, a safe haven since the 2008 financial crisis, fell much more than the S&P 500 in 2022. Meanwhile, IPOs had their worst year in decades, with 71 IPOs generating only $7.7 billion in proceeds—a plunge of 95% from 2021, according to the article.

There are many reasons for the tech sector’s woes aside from higher interest rates, from the potential energy crisis in Europe, wage pressures, and a slowdown in the global economy, as well as geopolitical tensions. The way forward for tech companies will likely see dramatic reductions in corporate spending in order to generate profits and get stocks rising again. That means more layoffs, as many of the layoffs already announced won’t be sufficient to get profits moving again, and possible restructurings. Michael Nathanson of MoffettNathanson points to Walt Disney’s reorganization under new CEO Bob Iger as a model for other companies to adjust to the market’s new environment: finding the core strength of the business and focusing on that rather than trying to branch out too far. But while that might benefit investors, consumers could feel the pinch in having to pay more for the company’s services and products, whose quality could suffer.

Investors should pay attention to valuations. Because the Fed has clearly indicated that rates will continue to go up, putting a cap on stocks, investors shouldn’t rely on simple measures like revenue multiples and should avoid companies with structural issues. Nathanson highlighted Snap and Roku as two such companies that have stock-based compensation, which isn’t profitable if the stock declines. Instead, investors should seek out companies that have a clear, short-term road to solid profit growth. Once investors have identified profitable companies, they can follow trends. Cloud computing, e-commerce, payments, and sustainable energy are all businesses where there may be companies who are early on in their long-term growth track, Daniel Ernst of Rebeco Institutional Asset Management told Barron’s. And of course, investors should practice patience; it’s likely that by the end of this year, tech companies will begin to grow again.

———————————————

Validea runs stock and ETF models based on investment strategies with proven long-term track records. If you’re new to Validea, consider taking a look at our product overview or introductory videos.