By Jack Forehand, CFA (@practicalquant)

I usually like to write articles where there is a clear conclusion at the end. I also usually like to write about topics that I feel that I have a complete grasp on. This week, I will do neither of those things. The reason is that the topic I am going to cover is both one that I think is very important in the investing environment we find ourselves in today and a complex one with no clear answers. As I already completely gave away with the title of this article, that topic is the impact that the rise of passive investing is having on the market.

But before I talk about that impact, I think it is first important to set the stage and put the rise of passive in context.

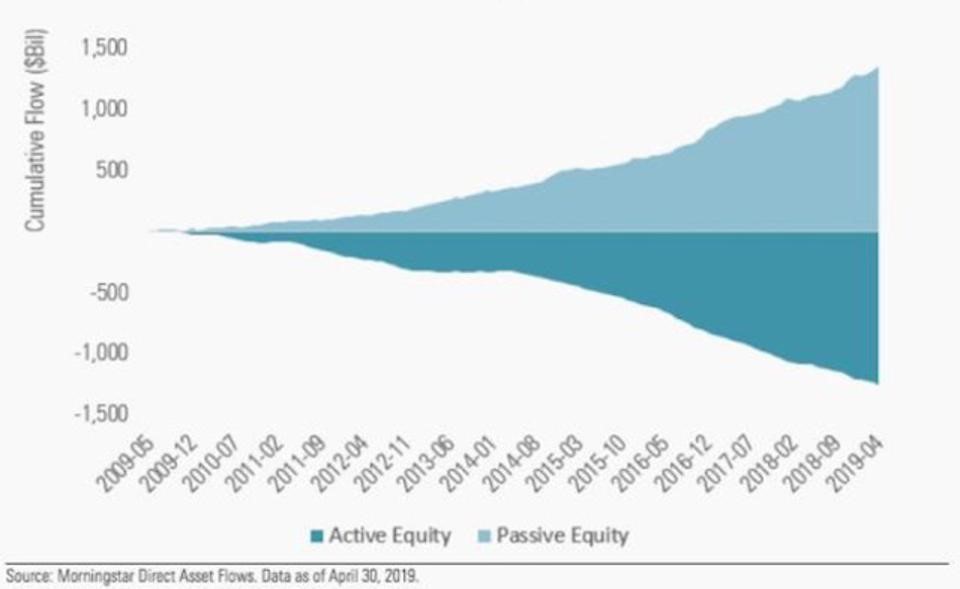

There are two important points to understand with respect to how the role of passive investing has changed in the market. The first, as this chart shows, is that there have been significant outflows from active funds to passive funds in the past decade. This trend has been consistent throughout the decade and continues to accelerate.

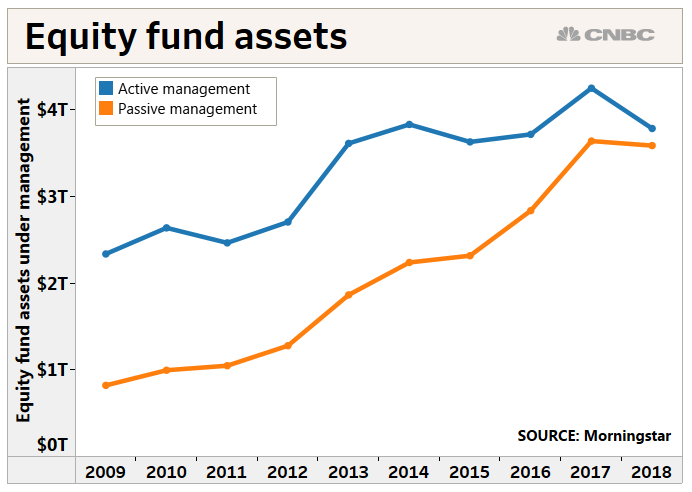

The second is that as a result of these flows, passive funds now account for a much larger percentage of the market.

https://www.cnbc.com/2019/03/19/passive-investing-now-controls-nearly-half-the-us-stock-market.html

Most estimates are that somewhere between 40% and 45% of the market is now passive, up from closer to 30% a decade ago and about 10% in the mid-90s.

The Impact of Passive Flows

There is little disagreement among market observers that passive investing is growing. There is also little dispute that the trend is likely to continue as a result of the rise of ETFs, investors’ focus on fees, the inconsistency of active manager outperformance, and numerous other factors. That is where the agreement ends, though. There are substantial disagreements as to if there has been an impact on the pricing of securities within the market, and if so, what that impact is.

As I mentioned earlier, there are many smarter people than me trying to figure out this issue, so I don’t pretend to have the answer. For a more detailed description of how passive investing could be impacting the market, I highly recommend that you listen to any podcast interview that Mike Green from Logica Funds has done. We also covered this issue in our most recent episode of the Excess Returns podcast featuring Corey Hoffstein.

There are two ways that some argue that the rise of passive investing is influencing the market. The first is that it has been a significant source of fuel behind the market and has caused it to go up more than it otherwise would have. The second is that it is impacting the relative pricing of stocks within the market and is benefitting the largest stocks that have the highest weights in market cap weighted indexes relative to all other stocks. I am going to focus on the second issue.

The Potential Market Distortion of Passive

Money has primarily been flowing into passive funds in a couple of different ways. First regular contributions to retirement plans have risen significantly. Since most 401ks rely mostly on passive options for regulatory and other reasons, this money is primarily going into passive vehicles. The second, as I mentioned before, is that investors are firing their active managers and moving their funds to passive investments. There is also a demographic issue. Younger investors, who are in the stage where they are adding to their retirement accounts, are predominantly using passive vehicles, while older investors, who are primarily withdrawing, have a much higher percentage of their portfolios invested in active funds. The combination of these two creates inflows into passive funds and outflows from active funds.

Given that passive funds are market cap weighted, all of this has the potential to create a situation where the largest stocks in the indexes are driven up relative to the others. It also can create a situation where small-cap stocks that are either not present or have very small weights in the major indexes are left behind all together. And the trend can feed on itself because active managers, as they continue to trail their benchmarks, will capitulate and start to build portfolios more like that market cap weighted indexes so they don’t get left behind.

To think about the impact of this, consider an example Corey Hoffstein gave us on our podcast. Assume there is a market with only three participants. One is a passive investor, one is an active growth investor, and one is an active value investor. Let’s also assume that the value investor decides to give up and move to a more growth-oriented strategy. He now has to sell some of his value portfolio and buy some growth stocks. To do that, he needs a buyer. The passive investor by definition doesn’t make active decisions so he or she would have no interest in buying. So the only person to sell to is the growth investor. But the only way the growth investor would be willing to buy the value stocks is if you give him a very attractive price. And the only way the growth investor will sell the value investor his growth stocks is if the value investor overpays for them. This results in a net effect of growth stocks going up and value stocks going down. This is obviously an oversimplified example, but if you carry the underlying principle to the market as a whole, you can see how all of this could benefit large growth stocks at the expense of smaller value stocks.

The Other Side of the Argument

Before all of us who are value investors give up and jump out of the way of the train of passive flows, I think it is important to note that there are arguments on the other side. Most of those arguments center around the role of active managers and market efficiency. In an efficient market, you would not expect distortions due to fund flows to sustain themselves. The reason is that active managers would step in to correct any mispricing. If the large-cap stocks that receive the majority of passive flows are driven up beyond the price that is justified by their fundamentals, active managers would be expected to step in and sell them to bring things back to fair value. So there is an argument to be made that the outperformance of large-growth stocks has been driven more by the expectations of the market for these companies and the actual results they have generated than flows into passive funds.

The Search for an Answer

In the end, the true impact of passive flows on the market is impossible to quantify. I have learned that when some of the smartest people I know in the investing world are at opposite sides of any given issue, it is likely that there is no one true answer. I did an interview with Michael Mauboussin, who is one of the best thinkers in the investment world, for our Five Questions series a year ago and I asked him about the influence of passive investing and flows on the markets.

Here is what he said:

This is a really vital question that I don’t know how to answer satisfactorily.

On the one hand, there is evidence that indexing has created some inefficiencies. For example, passive funds have to trade because of rebalancing and other issues, and there are opportunities for active managers on the other side of those trades. Further, there is evidence that indexing can have an impact on valuation and liquidity.

I would also make the observation that the substantial flows into index funds and the success of the growth factor have gone hand-in-hand. I don’t know that the relationship is causal, but the relationship between “expensive” and “cheap” stocks is toward the high end of historical ranges.

Yet, it doesn’t appear that it has gotten a lot easier to invest actively.

Ultimately, if I were to make the case for indexing distorting prices, I would turn to an argument based on the wisdom of crowds. Crowds tend to come to an efficient solution when there is heterogeneity of the investor population. If all of the investors behave the same way, the wisdom of crowds can yield to the madness of crowds. I don’t know that we are there, but that is what I would monitor.

When someone as smart as Michael doesn’t know the answer, then I am not sure the rest of us have much of a shot at figuring it out. But regardless of what the answer is, the rise of passive is likely going to continue. And if it is having an impact on the market, there will be significant implications for how we all build our portfolios. So whether you believe the rise of passive is changing the relative pricing of stocks within the market or not, it is certainly an important issue to follow going forward.

Jack Forehand is Co-Founder and President at Validea Capital. He is also a partner at Validea.com and co-authored “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Jack holds the Chartered Financial Analyst designation from the CFA Institute. Follow him on Twitter at @practicalquant.