Federal Reserve Chair Jerome Powell has abandoned his goal of a “soft landing” and is engineering something that could be much more difficult for the economy, according to an article in Bloomberg. The Fed’s new goal is to combat inflation by slowing down growth, leading to what economists dub a “growth recession” where unemployment rises and growth stagnates for an extended period of time.

Likening the process to “dripping water torture,” Diane Swonk of KPMG LLC said that it would still be less painful than a sudden recession. Powell made public the Fed’s pivot at the central bank’s annual symposium in Jackson Hole, WY in August. Since then, stock prices have dropped in response, and Senators Elizabeth Warren (D-MA) and Mitch McConnell (R-KY) both expressed concern about a recession.

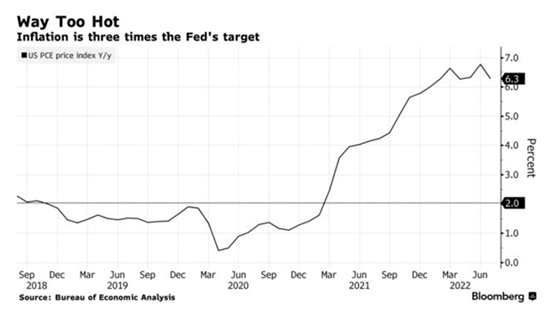

In the speech he gave in Jackson Hole, Powell called the labor market “out of balance” as the demand for labor far outweighs the supply, resulting in huge wage increases that are out of line with the central bank’s target of 2% inflation. Inducing a long period of slowed growth in order to lower the inflation rate will likely lead to higher unemployment after a 5-decade low of 3.5% in August. The Fed Chair said that it was better for households and businesses to feel the squeeze than for the central bank to be unable to restore price stability and have to take more drastic measures down the line, and left the possibility of another 75 basis-point interest rate increase on the table for this month, according to the article.

But slowing down the economy just enough to increase unemployment while also avoiding a recession is a fine line to walk, and many things could knock it off course, such as another surge in oil prices. And consumers feeling the squeeze will reduce their spending, which could lead to a contraction in GDP. The article points to two signs to look for in advance of a recession, the first being the Sahm Rule. Named for formed Fed official Claudia Sahm, it states that a recession begins when the 3-month unemployment rate moving average increases by .5% or more from its low for the prior 12 months. That statistic has always held, though Sahm herself told Bloomberg that everything the economy has gone through over the last 2 1/2 years has been highly irregular. The other sign is the housing market continuing to fall as the Fed raises rates; since WWII, there have only been three instances when a downturn in the housing market hasn’t signaled in a recession, and in each of those cases the Fed started raising interest rates well before inflation spiraled out of control.

However, some economists are highlighting recent data that’s been stronger than previously expected. Though Michael Gapen of Bank of America still believes a recession in the latter part of this year is likely, a more positive outlook on the labor market has made him doubt his own forecast. “History tells us that more likely than not, getting out of these situations requires more than just a few tenths of an increase in the unemployment rate,” he told Bloomberg.