BlackRock’s March announcement that the firm had reduced its staff of stock pickers to increase its focus on quant strategies may support the consensus that “active management is dying,” but Bloomberg columnist Nir Kaissar argues that “the problem is not that active managers fail to outperform the market; it’s that they keep that outperformance for themselves through high fees.”

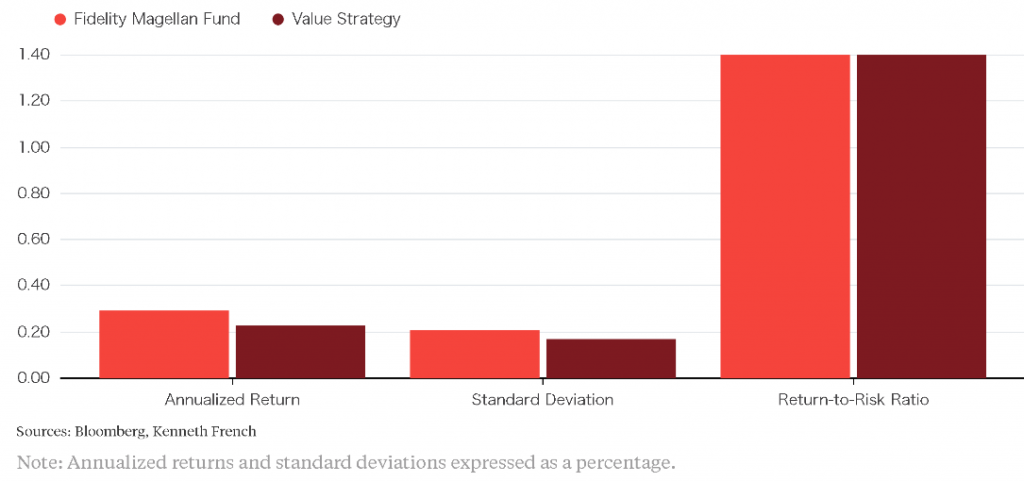

“Smart beta” index funds, on the other hand, have been able to beat the market at very low-cost to the investor. Kaissar offers data (provided by Dartmouth professor Kenneth French) showing that a “simple quantitative strategy” could have generated the same risk-adjusted return as that of Peter Lynch’s famed Magellan Fund during the period between May 1977 and May 1990 (see below).

However, Kaissar writes, “this doesn’t have to be doomsday for active managers.” Not everything can be automated, he argues, and “index providers have not been able to replicate the full menus of hedge fund strategies.” And, since investors are now pushing back on the hefty fees charged by these firms, writes Kaissar, “That opens the door for active managers to offer hedge fund strategies more cheaply, just as index funds have done with stock picking.”