By Justin J. Carbonneau (@jjcarbonneau) —

The odds of finding a pearl in your restaurant oyster are 1 in 10,000 to 1 in 12,000 depending on the species of mollusk.

http://goldsteinsjewelers.blogspot.com/2014/06/gem-mythbuster-pearls-found-in.html

This is an article about “shells” and financial “pearls”, but not the kind that come from the ocean. Instead, they’re the latest craze in the markets – SPACs. No, these are not “Sea Pearls Acquired on the Cheap”, but instead “Special Purpose Acquisition Companies”.

Historical Context: Stocks Down 50% In Last 20 Years

About a year and a half ago many were saying companies were staying private for too long.

Capital from venture capitalists was helping many growth companies remain private for longer, lowering the opportunity for public market investors to get access to these companies via the IPOs that these firms would have otherwise opted for during their life cycle.

The declining trend of public firms was nothing new though – over the past 20 years the number of firms in the Wilshire 5000 is down roughly 50% (many of them small companies) – but over the past year we’ve seen a massive uptick in what is known as SPACs, or Special Purpose Acquisition Companies as stated above.

Enter the SPAC

But what is a SPAC and should most investors care? This article sets out to answer those questions.

SPACs, which are also known as “blank check” companies, are shell companies, with no business, no product and only a team of investors.

From Shaquille O’Neal, former Disney CEO Michael Eisner, hedge fund titan Bill Ackman, tennis great Serena Williams, legendary entrepreneur Richard Branson and retired baseball star Alex Rodriguez, investors, influencers and athletes are getting in on SPACs. Some bring expertise and talent, others connections, while others bring attention and notoriety.

SPACs are launched with a purpose of buying or merging with a company that has a business or product and growing over time. SPACs go public in public markets via IPOs, but the capital raised during that process is earmarked for buying a business, typically a private entity, and maximizing value for shareholders. SPACs are considered more speculative investments by the SEC and therefore don’t carry the same disclosure requirements of a typical IPO. Furthermore, if the sponsors of a SPAC fails to find an investment within 24 months of going public, the funds need to be returned to shareholders, thus putting a time limit on finding a transaction.

The Rise of the SPAC

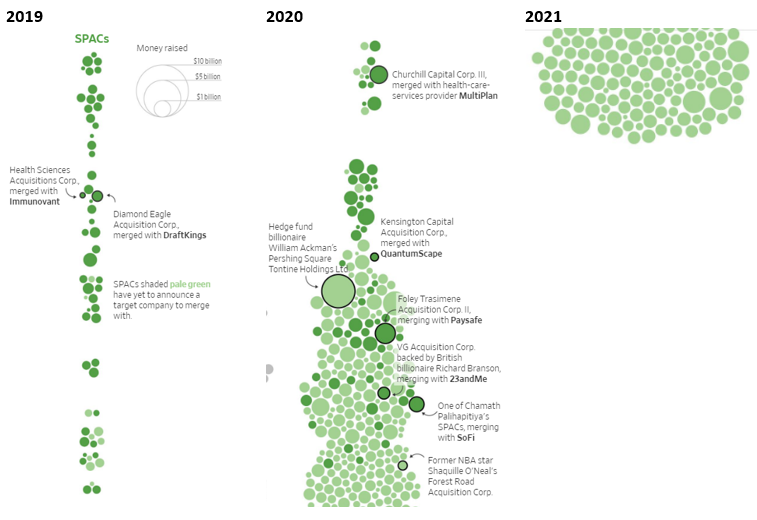

The rise of SPACs over the past few years has been nothing short of incredible. The visual below is taken from a WSJ article, The SPAC Boom, Visualized, and it shows just how many SPACs have come to the market over just the past two and a half years. As of this writing, in the U.S. over 550 SPACs haved filed to go public. Collectively, they are looking to raise over $160B in capital.

Larger Image and Full Article: https://www.wsj.com/articles/the-spac-boom-visualized-in-one-chart-11612962000

Validea as a SPAC — Cool Exercise — but I Don’t Think So

Let’s imagine for a moment Validea was acquired by a SPAC (obviously an unlikely scenario given our small size, but we will use it as an illustration). The management team here at Validea would negotiate a buyout price with the sponsors, thus taking out the volatility of what the price would be if we were to go the alternative route of doing a traditional IPO. Validea could avoid much of the regulatory requirements around tax, legal and risk disclosures and detailed financial statements, and the sponsors of the SPAC could promote the transaction much more aggressively than a traditional IPO. The sponsor has the money in the bank and is already public, so this gives a quick window of opportunity for the deal to get done as long as shareholders of the SPAC approve the deal. But there is an important detail, and it relates to how the sponsors really get paid. In most SPACs, the sponsor receives a 20% equity stake in the company. There are investment banking fees as well, but the big incentive for the sponsor is getting the equity in the firm. In some cases, the sponsor will put in their own capital, but this isn’t always the case. Matt Levine of Bloomberg wrote a detailed piece on SPACs fees (contrasting SPAC fees vs. a traditional IPO), and just like any type of investing it’s important to understand your total cost of ownership when investing in a SPAC vehicle.

Investors who are interested in SPACs should understand the risks, from not knowing what company the SPAC may buy, to the lack of transparency, overly ambitious projections, dilution via the sponsor promote, and the fact that often times these investments are made in emerging industries where there is significant growth and disruption and it’s difficult to predict the winners and losers. There is a laundry list of risk factors here and they are important to understand.

Short-seller Carson Block recently wrote “a business model that incentivizes promoters to do something — anything — with other people’s money is bound to lead to significant value destruction on occasion.” Because a SPAC has a finite amount of time to find a deal, it creates pressure to get something done before having to return the investors’ capital, and could force bad, unprofitable deals.

If you can accept all of that than maybe SPACs are for you, but for most investors they certainly should fall within the “too hard” pile.

Looking Back in the Future At SPACs

When everything is said and done, I think we’ll look back on the SPAC boom and it will have shades of other periods of time in markets where things went a little haywire. We’ll probably say:

- A few of these SPACs did exceptionally well and rewarded investors, those will be the ones we talk about the most.

- The evidence will show a lot of them were duds, and those are the ones we’ll about the least.

- Regulators were probably a bit behind; and some of the firms with the most outlandish promises will be made of examples of.

- Some of these sponsors will have made a boat of “moolah”.

- Many investors will get likely loose money, a small few will do well.

Periods like this are part of the continuous evolution in the market. It’s important to understand the developments but you don’t always need to act on them. As is often the case with hot market trends, things typically get ahead of themselves, and it is important for investors to understand what they are getting, and the risks and rewards that come with it.

Justin J. Carbonneau is VP at Validea & Partner at Validea Capital Management.

Social | Podcast | Interviews | Articles

about Justin all in one place