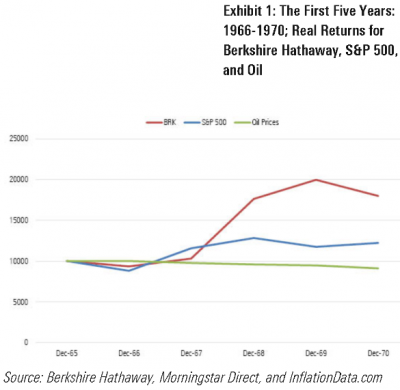

A recent Morningstar article offers an overview of Berkshire Hathaway stock performance since 1975 and whether it would have been attractive to an investor in the early days based on five- and ten-year historical returns.

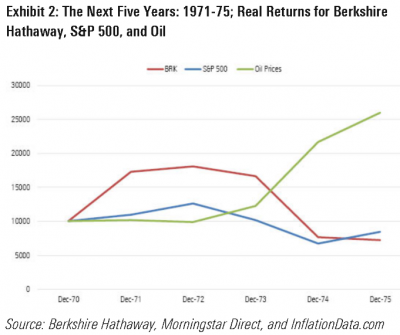

Regarding the second five-year period, the article asserts, “Boy, did things change,” adding, “In real terms, that whippersnapper Warren Buffett turned $10,000 of January 1971 money into just under $7200. The Oracle of Omaha indeed! More like the Numbskull of Nebraska.”

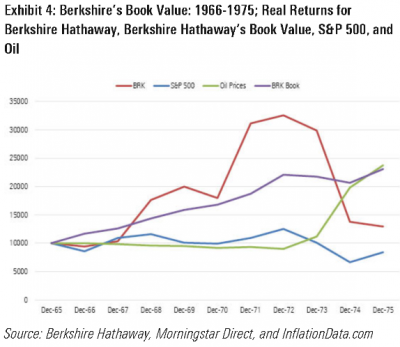

Underscoring the importance of book value in the discussion, the article notes that over shorter periods, Berkshire’s stock price “disengaged” from its book value. When evaluating the stock on that basis, things look considerably different:

“This time, we have a winner!” the article asserts. “The purple line of book value clearly beats the three alternatives. It has by far the steadiest performance and misses by a whisker of also posting the highest cumulative gain.”

The article concludes with the following takeaways:

- “By all means, don’t make decisions based on five-year returns.”

- “Ten-year totals are better, but still imperfect.”

- “Book-value growth judged Buffett’s quality better than did share-price performance.”