An article in CFA Institute offers an overview of how Buffett’s Berkshire Hathaway has avoided many of the major pitfalls suffered by other “star” investors and how, from a factor-investing perspective, the conglomerate has managed to outperform for decades.

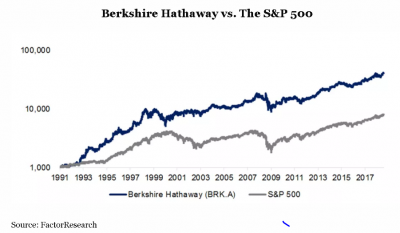

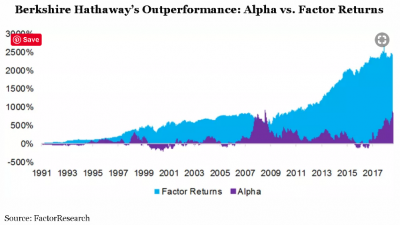

The article reports that Buffett’s “outperformance relative to the S&P 500 has been especially significant since 1991 and created immense value” for Berkshire shareholders. It adds that while there were some periods of underperformance, “these often turned out to be based on wise investment decisions that translated into superior returns later on.”

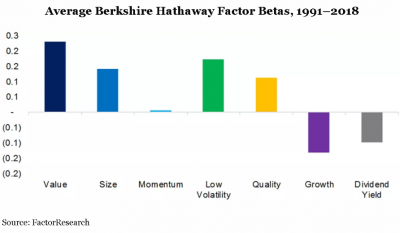

Based on a “factor exposure analysis” of Berkshire through a regression analysis of betas relative to common equity factors, the article said “a clear picture emerges: [Berkshire] had positive exposure to the Value, Size, Low Volatility and Quality factors as well as negative exposure to Growth and Dividend Yield.”

The article explains how the analysis paves the way for the creation of a “factor-mimicking portfolio” that can achieve similar outperformance relative to the S&P 500. But the analysis also finds that “most of the outperformance relative to the S&P 500 is explained by factor exposure, with little alpha generated over time:”

The article contends that, although fans of Berkshire might be surprised and even possibly offended by this suggestion, the findings showcase Buffett as an expert at something many find extremely challenging: selecting factors and combining them into multi-factor portfolios. “So,” the article concludes, “Berkshire Hathaway might be an alternative to multi-factor products. After all, the company is supported by a fund manager with a decades-long track record of skillfully managing factor exposure. The management fee is competitive compared to smart beta exchange-traded funds and Buffett’s stake in the company ensures that his interests are aligned with those of his investors.”