By Jack Forehand (@practicalquant) — Last week, I interviewed Liqian Ren of WisdomTree for our Five Questions series about multi-factor investing. The topics we covered were fairly complex so I wanted to take a step back and discuss some of the concepts in more detail.

The basic theory of multi-factor investing is pretty simple. It has been widely proven that factors like value and momentum can outperform the market over long periods of time. But no reward comes without risk. In this case, the risk is the significant periods of underperformance that the factors can endure. All the major factors have had periods as long as a decade that they have trailed the market. In fact, value is in the middle of one right now. The chart below from Larry Swedroe, director of research for Buckingham Strategic Wealth, which shows the percentage of time each factor underperforms, makes this point very well.

No matter which factor you look at, there are extended periods of underperformance.

That is where multi-factor investing comes in. In theory, multi-factor investing offers investors an opportunity to blend these factors together to reduce risk and smooth out those bad periods. If a portfolio can have some value and some momentum, and blend it with other factors like quality or low volatility, that can help to reduce both the length and magnitude of underperforming periods. It is similar to how a good sports team works. If you have enough good players, they will pick each other up when one player is having an off night.

The chart above quantifies how this diversification benefit works. Over a one-year period, each individual factor underperformed the market between 28% and 41% of the time. The combinations of the factors (P1 is the combination of the first 4, P2 is the first 5, and P3 is the first 4 and the 6th) underperformed between 12% and 23% of the time. The same effect is seen as the time frame expands, with the composites trailing the market substantially less for every period referenced. This is the benefit of multi-factor investing.

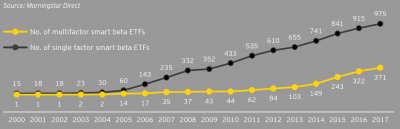

The appeal of multi-factor equity investing has resulted in an explosion in ETF strategies being offered to investors in the space. Since 2009, multi-factor ETFs have grown from 43 to 371. But not all multi-factor strategies are the same and these portfolios can be much more complicated to build in the real world than they seem. If the factor combinations are not put together properly, they can produce lower returns than the factors themselves, while also not achieving the diversifications benefits that the theory says they should.

Reshaping around the investor – Global ETF Research 2017, Ernest & Young

Here are a few things to keep in mind when analyzing multi-factor investing strategies.

Multi-Factor Investing is Not a Panacea

One of the two major reasons factor investing works is because it is risky. Combining a bunch of factors together isn’t going to change that, at least not completely. And in trying to change it, you have to be very careful that in an effort to reduce risk you aren’t also diluting the factor exposure you are trying to achieve. Turning a portfolio into the index you are attempting to beat in order to make it less volatile doesn’t serve much of a purpose if outperformance is what you are seeking. So just like with any other type of factor investing, your expectation going in should be that you will have extended periods where you underperform. These periods may be shorter and narrower than with individual factors, but they will still be there.

Which Factors You Use, And How You Combine Them, Is Important

Not all multi-factor portfolios use all the major factors. Most use value and momentum, but some stop there and others add additional factors, including some like the correlation factor WisdomTree uses that are outside of the standard factors.

And once you select the factors, you then have the issue of how to combine them.

As I discussed with Liqian in the interview, there are two main ways to build multi-factor portfolios. I call the first one the sleeve method and the second the consensus method. The sleeve method just takes individual factor portfolios and combines them together. For example, if I wanted to build a 3 factor, 30-stock portfolio using value, momentum and quality, I would just take 10 value stocks, 10 momentum stocks and 10 high quality stocks and combine them together.

In a 2015 article, Jack Vogel of Alpha Architect endorsed this approach. In talking about why they favor it, he said the following

The evidence suggests that we keep highly active exposures to value and momentum in their purest forms (assuming we are doing high-conviction non-watered down versions of the anomalies). Blending the strategy dilutes the benefit of value and momentum portfolios. The summary of the benefits of a pure value and a pure momentum approach can be summarized as follows:

- Easier ex-post

assessment

- E.g., if we mix and match value/momentum it is more difficult to identify the drivers of performance after the fact.

- Stronger portfolio

diversification benefits.

- Pure value and pure momentum strategies have lower correlations than “blended” versions.

- Stronger

expected performance.

- Running pure value and pure momentum in highly active forms generates higher expected performance than blended systems.

Others like WisdomTree are proponents of the other approach. In my interview with Liqian, she explained their support of this method using a basketball analogy.

If you want to win a basketball game, you don’t want a team where one person is only great at 3-point shooting, the other only great in dribbling, and the other only great at passing the ball. You want a team with players who stand out at shooting but are also good at dribbling and passing the ball. An individual sleeves approach will invest in stocks that are high value and very low momentum or other factor dimensions.

As a result of this multi-factor construction, value stocks within multi-factor don’t necessarily behave the same as a stand-alone value strategy. We believe both philosophically and empirically that this approach is the better approach.

Whenever you have people this smart on both sides of the debate, there likely is no correct answer. So the point isn’t that one approach is better. The key is just to understand what you are getting because different approaches can produce very different outcomes.

Portfolio Construction Plays a Major Role

Which factors to use and how to combine them is only part of the equation. There are also decisions like how many stocks to include in the portfolio and how to weight them that can play a big role in both risk and return.

Focused factor portfolios tend to perform better, but they also tend to be more volatile and will have more extended periods where they underperform and outperform. For investors who want a smoother ride, more diversified portfolios can work better, but you need to be careful that the portfolio isn’t so diversified that it becomes the benchmark and loses its factor exposures.

Position weighting within the portfolio is also a source of significant differences. Many portfolios are just equally weighted, but others can be weighted based on conviction (with the highest scoring stocks receiving the largest weights). Inverse volatility weighting has also become more prominent. The theory of inverse volatility weighting is that you want each position in your portfolio to contribute an equal amount of risk. The least volatile stocks get the largest weights and the most volatile stocks get the lowest weights. This can serve to reduce volatility in a portfolio, but it also can cause its performance to be more tied to the performance of low volatility stocks in general.

One Question – Many Answers

In the end there is no perfect solution here. There is no optimal way to build a multi-factor portfolio. The right answer for one investor is likely different than the answer for another. It is important, though, that the techniques that are used to build the portfolio are thoughtful and have proven themselves over time. And as is the case with most things in investing, the most important thing is your conviction in the approach you select. Without that, even the most carefully constructed multi-factor portfolios will fail to deliver the results you desire.

Jack Forehand is Co-Founder and President at Validea Capital. He is also a partner at Validea.com and co-authored “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Jack holds the Chartered Financial Analyst designation from the CFA Institute. Follow him on Twitter at @practicalquant.