By Jack Forehand, CFA (@PracticalQuant)

The current bear market seems just like 2000. We had massive outperformance from growth and technology names coming into it, with small-cap value companies being left behind. And we had well above average valuations going in as well, just like we did here. So that must be the perfect

Actually, on second thought, I see a lot of similarities to 1987. We had a major crash there in a short period of time. We had the same thing here. So if I want to figure out where we go from here I need to look back to that period.

Or maybe 2018 is my best comparison here. We had a quick decline, buying the dip was the right move, and we were quickly off to all time highs.

You know what? As I think about it more, it seems like the Great Depression is the perfect analogue for our current situation. We have now shut down our economy completely for an indefinite period of time. This should likely lead to complete economic collapse. If I am going to build a playbook for what happens next, I need to learn from what happened there.

As you have probably figured out already, there was a large element of exaggeration to everything I have written so far. But I think what I did above is a valuable exercise to go through because it illustrates an important point. Whenever we are confronted with a bear market, we all want to figure out how it will play out. We want to know how big the decline will be. We want to know when it will end. We want to know what stocks we should buy to limit losses during it and to outperform the market after it. To answer these questions, our minds tend to point us to the simplest solution we can find. That solution is often to find the bear market in history that was most comparable to this one, and to assume that what happened then will also happen now.

But there is a major flaw in that argument: no two bear markets are alike.

As a quant, I am always thinking about the statistical significance of any conclusions I can draw from my testing. There are many factors that influence the level of confidence you can have in the results of historical results, and some of them are complex and can be difficult to understand. But

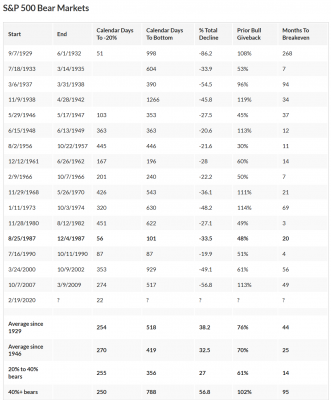

The most important thing to understand when trying to use past bear markets to predict future ones is what we call “n”. “N” simply refers to the number of observations in a sample. In general, the more observations you have, the better the conclusions you can draw. In the case of historical bear markets, “n” is very small. There are different ways of defining bear markets, but no matter how you do it, there likely have been less than 25 in history.

If you look at 90 years of market history and something has only occurred less than 25 times, there are likely very few conclusions you can draw from those occurrences with statistical significance. The only conclusions I might draw from reviewing past bear market data are actually very simple:

- They are all very different in terms of their length, depth and time to recovery.

- They are all always eventually buying opportunities and stocks have always come back.

But given that there will still be inevitable comparisons between what is going on now and past bear markets, I thought it might make sense to take a look at some of the comparisons that are frequently being used, and how they differ from our current situation.

2000 Bear Market

On the surface, the setup going into the 2000 bear market seems very similar to the current one. In both cases, you had a long bull market where technology and growth stocks led the market on the way up. In both cases, you also had a market that became overvalued toward the end of the bull market.

There were also some major differences, though. First, the 2000 market had many more signs of a bubble, particularly in technology shares. Many of the companies that led that bull market did not make money. Valuations were also much higher. And there was a huge IPO boom that led many companies to go public that had no business doing so based on the fundamentals of their businesses. There also was a euphoria that wasn’t present this time around.

The 2000 bull market also saw growth stocks become very expensive relative to value stocks like the most recent one, but on an absolute basis, value stocks were actually cheaper going into that bear market than they were going into this one (although that has since changed).

Using the 2000 bear market as an analogue is a great example of why it is challenging to use past bear markets to predict future ones. Despite the differences, that bear market had a similar setup to the current one, and that led many to predict that value stocks would outperform now, just like they did then. But as we all have seen, the opposite has happened so far in this bear market, with value leading the way down.

1987 Bear Market

The main similarity between the 1987 bear market and the current one is obvious: both happened very quickly. The current market didn’t suffer a 20% drop in one day, but it was the fastest bear market to reach a 30% loss ever. Outside of that similarity, these two bear markets have very little in common. The 87 crash was exacerbated by a variety of structural issues that are much less likely to occur today, and trading curbs have been put in place to prevent this type of situation from repeating itself. That bear market was also not accompanied by a recession, and that outcome seems very unlikely to repeat itself here.

Great Depression

The Great Depression always seems to be pulled out as an example during bear markets by people who focus on the worst-case scenario. It happened in 2008, and it is happening now. But many things have changed since then that make a repeat of that scenario much less likely. For instance, we have learned a lot about monetary and fiscal policy since then. During the Great Depression, government authorities did the exact opposite of what they should have. The Federal Reserve raised rates and allowed the money supply to fall.

The Unique Nature of Bear Markets

Studying past bear markets offers all of us an opportunity to learn. We can learn from what caused them as well as what worked and didn’t work in our responses to them. But it is also important to understand that no two bear markets are the same. We all tend to think that what happened in past bear markets, especially the most recent ones, will repeat itself, and that tendency can sometimes get us in trouble. So as you see all the comparisons to past bear markets you will see in the coming weeks and months, keep in mind that no two bear markets are the same, and we shouldn’t expect history to repeat itself exactly. For long-term investors, staying the course during bear markets has consistently been a good decision, but predicting how they will play out is likely a losing game That is perhaps the most important lesson from past bear markets.

Jack Forehand is Co-Founder and President at Validea Capital. He is also a partner at Validea.com and co-authored “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Jack holds the Chartered Financial Analyst designation from the CFA Institute. Follow him on Twitter at @practicalquant.