By Justin Carbonneau (@jjcarbonneau)

Imagine for a moment you were one of the very first investors in Berkshire Hathaway in 1965 and you’ve stayed committed to Buffett all these years (54 years and counting be exact).

You’re meeting him today to profusely thank him for producing the results he has.

You say, “Warren, I want to thank you for producing the long-term outperformance over the market you have delivered on my investment. You’ve more than doubled the market over the last 50+ years, which is unbelievable. I can’t thank you enough!”

Warren responds, “Yes, you are right Berkshire has produced significant excess returns over the market, but those returns wouldn’t have been achieved if you didn’t exhibit client alpha, which is the mindset, perspective and long-term commitment needed in order to actually achieve those returns”.

Wait a minute, Warren is thanking me? That’s right, he is.

Of course, this is a completely made-up conversation but somewhere along the way I heard the idea of “client alpha” and it came back to me again after coming across a 2010 interview with Seth Klarman and Jason Zweig (Opportunities for Patient Investors) that was published in the Financial Analysts Journal.

Klarman says …

“Having great clients is the real key to investment success. It is probably more important than any other factor in enabling a manager to take a long-term time frame when the world is putting so much pressure on short-term results.”

You seldomly hear a top performing investment manager giving credit to something they effectively don’t control, but this is the exact reason why I found the quote from Klarman so interesting.

Most investors like Buffett and Klarman who generate alpha or superior risk-adjusted long-term returns are often credited with having some type of advantage in their process, whether it be informational, analytical, behavioral or some combination of all three. Their success is often discussed as the result of the process of how they go about managing money or managing risk. That is true.

At the same time, however, these returns can only be realized if those who are invested with them stay committed and understand the drivers and realities of achieving those returns.

No Strategy Always Works

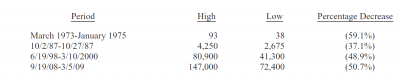

Most people focus on Buffett’s incredible long-term track record of outperformance, but it hasn’t always been an easy ride. As Newfound Research pointed out in this piece, “Outperforming by Underperforming”, there have been periods of difficult returns, both absolute and relative to the broader market. Even Buffett himself, in his 2017 Shareholder Letter, points to four times the stock of Berkshire Hathaway has fallen significantly. Three of those times the stock price was cut in half. Investors who jumped shipped during any of these declines most likely wouldn’t have been around for the subsequent recovery in the shares.

Source: 2017 Berkshire Hathaway Shareholder Letter

Another example some investors may be familiar with is the performance of the CGM Focus Fund during what was known of the lost decade for stocks from 2000 – 2009. While the fund produced an 18% annualized gain in a ten year period where the market went nowhere, your average investor in the fund lost 11% annually. You might wonder how that’s possible. The answer is that it is a result of very bad timing and investors coming into the fund after good bouts of performance and exiting after lackluster returns.

Sources of Client Alpha

The examples above show how important it is to get the right clients on the bus so that they can achieve the returns a strategy has to offer. Klarman points to a few examples of what makes for an ideal client. He says …

“In our minds, ideal clients have two characteristics. One is that when we think we’ve had a good year, they will agree. It would be a terrible mismatch for us to think we had done well and for them to think we had done poorly. The other is that when we call to say there is an unprecedented opportunity set, we would like to know that they will at least consider adding capital rather than redeeming.”

I thought it would be a good exercise to think through the other drivers of what may contribute to client alpha. The list below is by no means exhaustive, but it builds on Klarman’s idea that successful investing through value or other active strategies that have the potential to beat the market over time requires the right type of clients with the following qualities.

- Controlling Emotions: the best clients can control their emotions and control the biases that often detract from long-term returns. At the end of 2008 and beginning of 2009, with the markets in freefall, many investors sold into those declines and panicked. For many, those losses, which were temporary, became permanent losses.

- Taking a Long View: Long term means different things to different investors, but research has shown that even in periods as long as 10 and 15 years there is a potential, albeit a small one, of losing money in the stock market. And even with factors like value that have been proven to produce outperformance over time, there is a 6% chance of losing money over a 20-year period based on historical returns. Those clients who take the longest view possible are the ones who typically can get the most out of a good strategy.

- A Belief Through Education and Understanding: Having discipline and taking a long-term view can only be achieved if the client believes in what they are investing in. A key driver of that belief has to do with education. The more a client can educate themselves about a strategy, the better potential they have to understand what to expect from it. That understanding leads to belief and that belief is important in establishing the discipline and long-term commitment needed in order to achieve its full potential.

- Taking “I Don’t Know” as an Acceptable Answer: In a world full of forecasts and predictions (at least on most major business channels) many investors often think there must be a reason the market did this or a stock did that or a strategy did this. But that’s not the way it works. There are so many variables at play. No one has every answer or can provide a complete picture of every single factor that influences markets and drives returns. Investors who understand this know that the words “I Don’t Know” aren’t necessarily a bad thing but rather an acknowledgement that not all the moves or complexities of the market can be easily explained.

- Understanding the Role of Luck: Luck plays a big role in investing (click here for more on luck and investing). You could start investing with a manager right at the start of a new bull market, at the start of a bear market or somewhere in-between. The performance at the outset plays an important role in how many investors perceive things going forward. Understanding that the timing of when you allocated your capital is random and that there’s no way to know with anything close to 100% certainty what the future holds is important.

While none of us should be sitting around waiting for a “Thank You” note from Buffett, what both investors and money managers should be thinking about are ways to improve on and increase their client alpha. This is one area where the interests of investment advisors and their clients are completely aligned.

Photo: Copyright: 123rf.com / mcmortygreen