When meeting with clients, Steven Podnos (principal at Florida-based Wealth Care LLC) shared with the Wall Street Journal how he explains the negative impact of emotional decision-making on an investment portfolio.

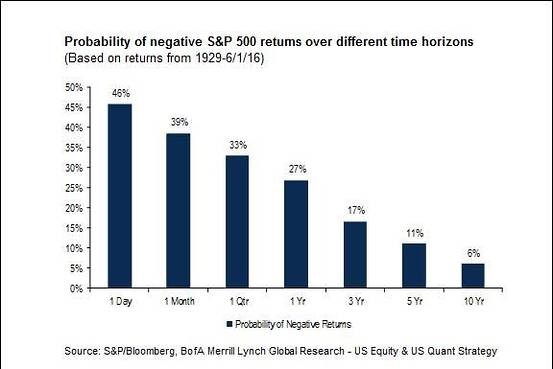

“Over a short period of time,” says Podnos, “you’re almost as likely to have an up market as you are to have a down market. If you can wait five years, then about 90% of the time you’re up in every five-year period. You’re going to be pretty happy.” Podnos shows clients the following chart to illustrate how buying and holding can eventually pay off:

While he knows that a check-in every five years is probably not realistic, his goal is to discourage clients from daily monitoring. “It will just make you feel bad,” he says, “or make you make mistakes.” According to Podnos, those who invest in stocks should have at least a 10-year time horizon. For those that need their money sooner, Podnos suggests purchasing CD’s.

“They always kind of look at me and say, ‘CDs are paying 1%.’ I say, ‘yeah, but you’ll get your money back, plus 1%”.