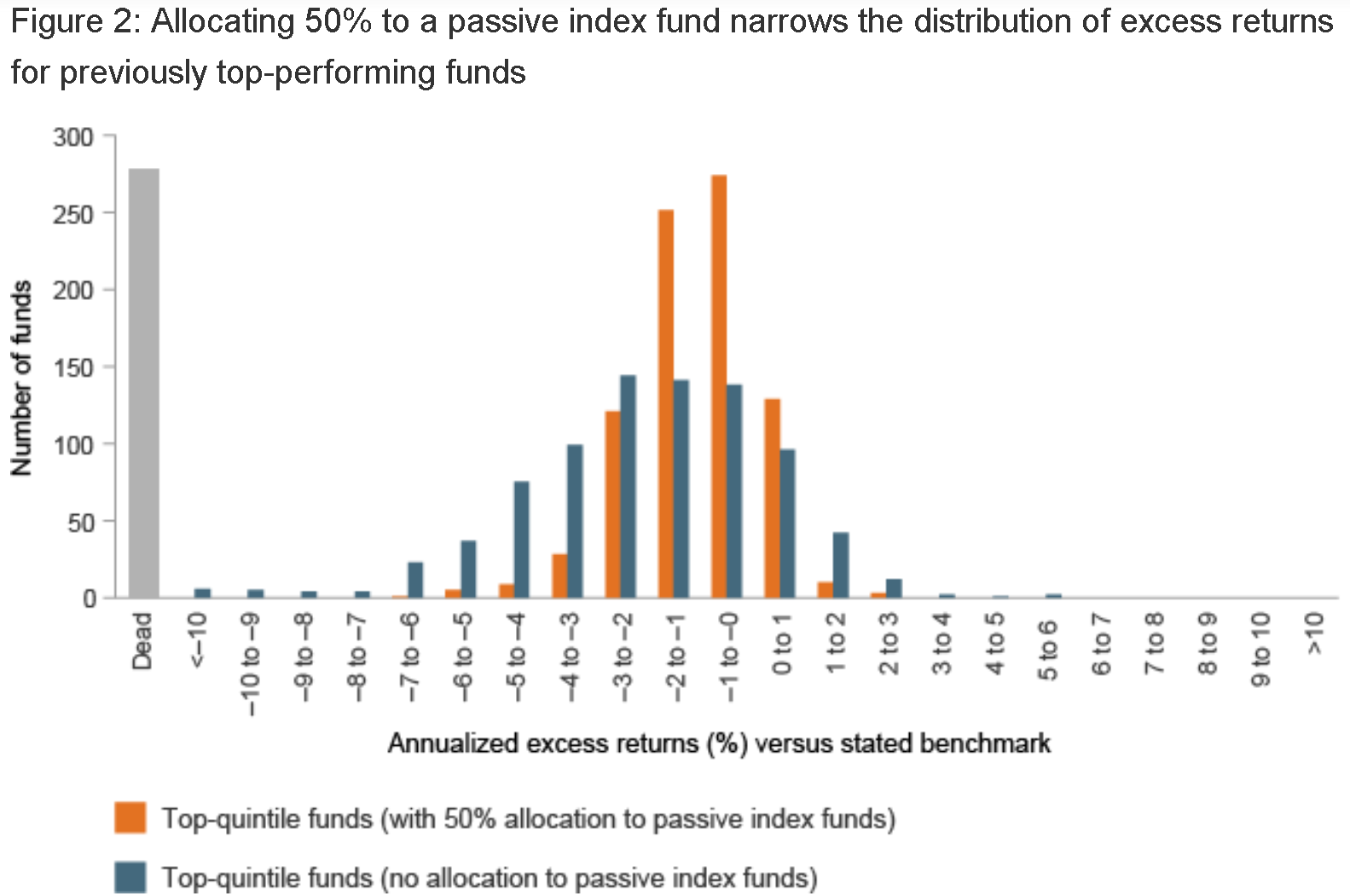

A “partnership” of both active and passive investing can help smooth out some rough patches in portfolio performance, according to a recent Vanguard article.

“The addition of a reliable investment partner—a broadly diversified, passively managed investment—can theoretically narrow the range of outcomes, helping you stick with a plan that offers the potential for outperformance while limiting the chances of significant underperformance.”

Even the most skilled active fund managers, the article points out, will suffer periods of underperformance—but combining once-top performing actively managed investments with a diversified, passive index fund can reduce the risk of significant underperformance:

Such a combined strategy, the article argues, can “reduce the impact of negative performance—and consequently, the risk that you’ll be tempted to abandon your long-term plan. You can give yourself the best chance of active-investing success by choosing highly talented investment professionals, maintaining low relative costs, and sticking to your long-term plan.”