By Justin J. Carbonneau (@jjcarbonneau) —

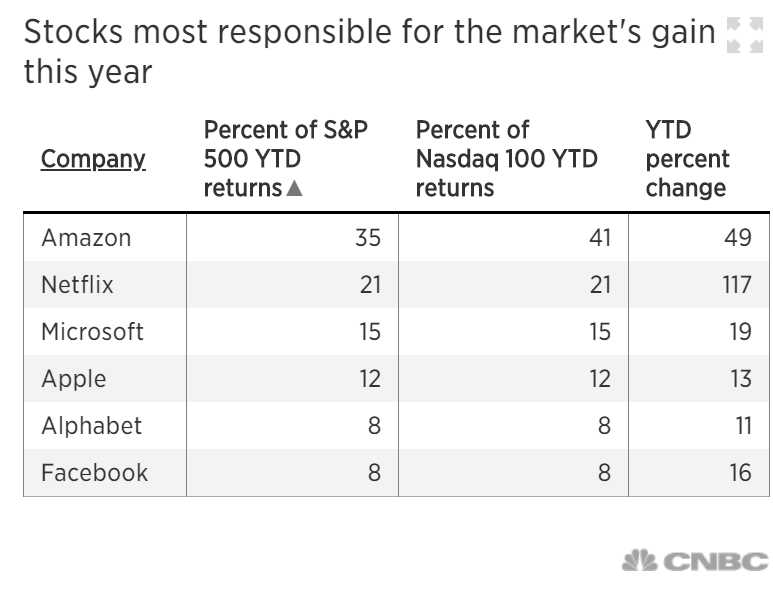

About a week ago CNBC had a piece that broke down how much the largest, best performing stocks have contributed to the overall market’s rise this year as tracked by the S&P 500. The table below shows that 99% of the market return in 2018 can get boiled down to a handle of tech darlings — Amazon, Netflix, Microsoft, Apple, Alphabet (Google) and Facebook. The average return of all five positions was about 37%, a big percentage increase for a set of large, dominate companies.

For investors, a logical question might be how one could have identified these positions in advance. Yes, they are tech behemoths, disrupting industries and generating profits and have healthy returns on capital in many cases, but those ingredients don’t always lead to market outperformance. There are so many factors at play when deciding whether or not a stock should be bought and future gains will be realized, but the one factor that may have brought you into any of these names over the past year or so is momentum, or strong price strength relative to others stocks in the markets.

Source: https://cnbc.com/2018/07/10/amazon-netflix-and-microsoft-hold-most-of-the-markets-gain-in-2018.html

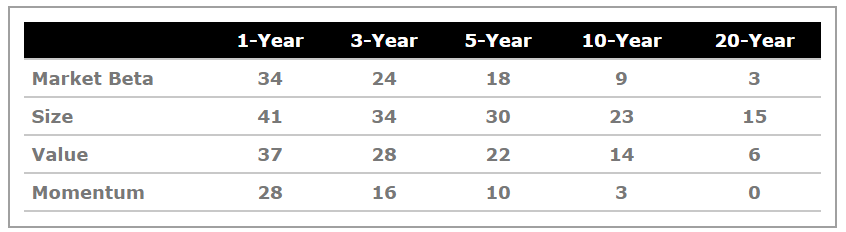

We’ve referenced the chart below a few times in our various writings here at Validea. The chart, courtesy of Larry Swedroe, director of research for The BAM Alliance, shows the percentage of time (since 1927) factor premiums have underperformed over different time periods. So for example, in the chart it shows that in any one year period value stocks, historically, have underperformed 37% of the time. In any three year period they’ve underperformed 28% of the time and so on. The chart is useful for two reasons. First, it shows that there are long periods when any of factor can underperform – 6% of the time value has underperformed for a 20 year period! The second observation is across all periods (1, 3, 5, 10 and 20 years) the momentum factor has shown the most persistence in producing a premium. In fact, it’s the only factor with has generated a premium over all 20 year periods. So given the stellar returns out of technology leaders and given the data below it must be true that momentum is a winning investment strategy then right?

Well, not so fast.

Source: http://etf.com/sections/index-investor-corner/swedroe-value-premium-lives

In October of last year, Rob Arnott, and his team of researchers at Research Affiliates published a paper, “Can Momentum Investing Be Saved?“. The paper looks at the actual performance of momentum strategies and finds very little evidence of momentum working in the real world.

The researchers write:

On paper, momentum is one of the most compelling factors: simulated portfolios based on momentum add remarkable value, in most time periods and in most asset classes, all over the world. So, our title may seem unduly provocative. However, live results for mutual funds that take on a momentum factor loading are surprisingly weak. No US-benchmarked mutual fund with “momentum” in its name has cumulatively outperformed its benchmark since inception, net of fees and expenses. Worse, because the standard momentum factor gave up so much ground in the last momentum crash of 2008–2009, it remains underwater in the United States, not only compared to its 2007 peak, but even relative to its 1999 performance peak. This means 18 years with no alpha, before subtracting trading costs and fees!

Momentum strategies, they say, have three pitfalls that hurt returns.

- high turnover, in crowded trades, which leads to high trading costs;

- a careless sell discipline, because momentum’s profits accrue for months, not years, and then reverse course; and

- repeat winners (and losers), which have been soaring (or tumbling) for so very long they enjoy little or no momentum follow-through.

So on paper, momentum looks robust, but when it comes to the actual implementation by the investment community, momentum seems to have fallen short.

Validea’s Momentum-Focused Strategies

We have some of our evidence that shines a little light on momentum, at least when it’s combined with other fundamental variables.

Here at Validea, we run two strategies publicly and more behind the scenes that have a high degree of focus on momentum type stocks. The key difference is our models utilize momentum as one input variable in the context of a model with multiple investment criteria. For example, the Small Cap Growth Investor model, which was extracted from one of the books from the Motley Fool founders David and Tom Gardner, looks for stocks of growing companies exhibiting quality characteristics that have stock price momentum at their backs. The other model is one that combines strong price momentum and earnings growth and other fundamental quality factors.

Since 2003 in the U.S. and 2010 on Canadian and South African stocks we have been tracking the performance of these in model portfolios, allowing us to see how the strategies have performed. The table below shows these two momentum models and how they rank, based on their performance since inception, compared to the other public model portfolios we run.

In the U.S. the Small Cap Growth portfolio is the #1 performer and the Momentum model is in the #4 slot. Performance is robust in Canada as well, with the Momentum model in the #1 position and the Small Cap Growth in the #4 slot. In South Africa, the Momentum strategy is in the poll position and the Small Cap Growth model is a close second.

| Small Cap Growth Model | Momentum Model | |

| U.S Performance Rank | #1 out of 12 | #4 out of 12 |

| Canadian Performance Rank | #4 out of 12 | #1 out of 12 |

| South African Performance Rank | #2 out of 12 | #1 out of 12 |

Always Asking “Why”

Anytime you are presented with an investment strategy and performance, you should ask yourself the “why” behind it? Why does the strategy work? What are the sources of return, and are those sources logical and do they make economic sense? Is the strategy actually implementable in the real world? When will the strategy likely struggle? These questions aren’t always easy to answer, but in looking at our momentum tilted models, there are a few things that stand out.

When the trend is persistent, momentum seems to shine. A good example here is the case of technology stocks over the last five years. They have been stellar performers, and a momentum formula for selecting stocks would have had you in these names.

When the trend changes abruptly and there is overvaluation, momentum can lose a lot. We can use technology in this example as well, but in looking back to 2000-2002. Going into that bear market, technology stocks were exhibiting the most momentum and when the floor came out from many of those companies, the losses were significant.

Momentum is high in turnover. As Arnott’s paper points out, momentum strategies can be hard to implement due to the high degree of turnover. The Small Cap Growth and Momentum models have high turnover so following these approaches for most people would be difficult and following these models with any significant amount of capital could prove difficult due to the direct and indirect trading costs. With that being said, trading costs have come way down and there are online brokerage firms like FOLIOfn Investments and Interactive Brokers that make implementing highly active approaches achievable for most individual investors.

The totality of the long-term evidence shows that momentum can work but implementing a successful momentum strategy may not be as simple as many think. As is the case with any strategy, if you take the time to understand the “why” behind it and the details involved in implementing it in the real world, you will be best setup to take advantage of its long-term outperformance.

Photo: Copyright: kagenmi / 123RF Stock Photo

Justin J. Carbonneau is Partner at Validea Capital Management and Validea.com. You can follow Justin on Twitter @jjcarbonneau.