In an article in The Wall Street Journal, Jason Zweig writes about inflation fears and the Wall Street pundits who peddle it, and portends that you are probably better protected against a decline in purchasing power than you think you are.

Don’t overhaul your portfolio just yet, Zweig writes. Predictions of future inflation have generally been wrong throughout history, and assets that are often sold as a solution to inflation don’t usually pan out; Zweig points to gold in the article, which has often failed to keep up with cost of living increases, as an example. Bitcoin, meanwhile, has protected its holders from inflation so far, despite price volatility, because its quantity is limited to 21 million.

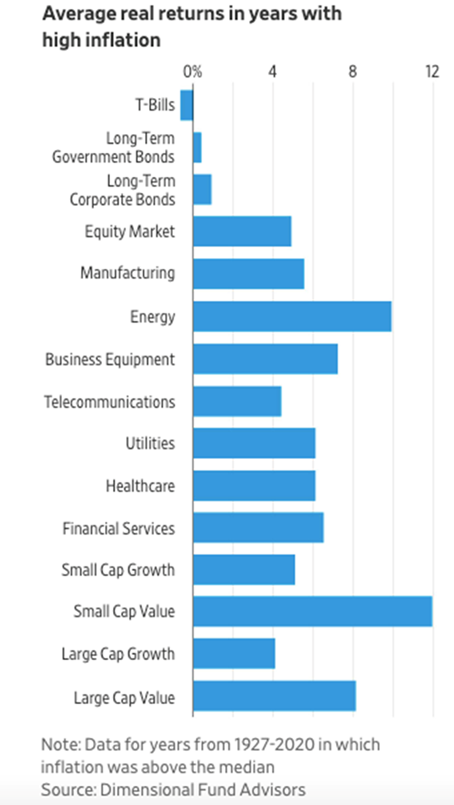

Asset managers are promoting value stocks, which tend to combat inflation, over growth stocks, whose earnings are reliant on what happens in the future. Growth stocks could be hurt if inflation eats away at their present value, making them less profitable in the future. Value stocks have traditionally done better than growth during times of rising consumer prices, but the difference today is the number of tech companies dominating the growth stock indexes. However, Zweig continues, it’s not certain that those growth stocks would underperform or get pummeled by value stocks, even if living costs spike.

Energy stocks and commodities aren’t great hedges against inflation either, because they’ve swung so wildly between gains and losses over time. Zweig maintains: “If your stock portfolio is already well diversified, it should be able to keep pace with modestly rising prices.”

Beyond that, adding Treasury inflation-protected services (TIPS) might give you some piece of mind…but they raise your fees in order to protect against something that could turn out to be a phantom.