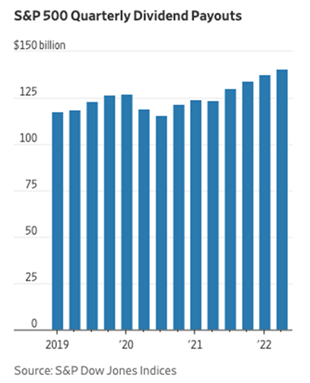

The second quarter saw dividend payouts hit a record, a good sign for investors who have relied on income-producing stocks during this year’s slowdown, reports an article in The Wall Street Journal. According to S&P Dow Jones Indices, S&P 500 companies paid out $140.6 billion in dividends in the second quarter, an increase of $3 billion from the first quarter and $17.2 billion from the same period in 2021.

Yearly dividend payouts have increased every year for the past 10 years, aside from a dip in 2020. Analysts forecast that dividend payouts will continue to set new records for the rest of this year at a quicker pace than is typical, with companies posting strong earnings. Indeed, senior Dow Jones analyst Howard Silverblatt estimates that payouts will shoot up more than 10% this year, topping the $511.2 billion that set the record last year. The healthy dividend payouts are a signal to investors that their investments are still growing, in spite of the challenges companies are currently facing, the article contends.

As the equity market has struggled against economic headwinds, dividend stocks have gained popularity this year as investors look for a steady source of income that can withstand volatility. Though the S&P 500 has dropped 20% so far in 2022, the S&P 500 High Dividend Index has only fallen 4.7%, with several high-quality stocks such as Coca-Cola and AT&T beating the market. That outperformance displays how the market has shifted this year. As interest rates and inflation have increased, investors have shied away from the megacap tech shares and stocks with high valuations that pushed the major indexes into the stratosphere for the last 10 years, turning instead to more reliable dividend-payers. Industries such as utilities, telecommunications, and consumer staples tend to provide the sort of stable profits that investors are flocking to in the current environment.

Buybacks are also at record levels, and corporations generally favor stock repurchases over dividends, since share prices are usually quick to respond to buybacks. Analysts, however, expect the ratio of buybacks to dividends to level off for the rest of the year as harsh economic conditions start to take their toll on companies’ earnings. Even so, “[t]he dividend growth outlook will be more muted as we go into the next couple of years versus the last year,” Chris O’Keefe of Logan Capital Management tells The Journal. However, the outlook for dividend strategies is still positive, and the steady growth is going to be very valuable to investors during any slowdowns that might happen in the near future.