The stock picking strategy referred to as the Dogs of the Dow— that calls for buying the 10 highest-dividend-yielding stocks in the Dow Jones Industrial Average—was a bust in 2020, lagging well behind the index’s 8.2% total return. This according to a recent article in Barron’s that argues 2021 could be a different story.

The time-tested investment strategy is described by the article as a “classic value-oriented, contrarian strategy” that in 2020 included the following names:

- Dow Inc.

- Exxon Mobil

- IBM

- Chevron

- Pfizer

- 3M

- Walgreens Boots Alliance

- Cisco Systems

- Coca-Cola

- Verizon Communications

Two of the companies are no longer in the index, the article reports: “Exxon and Pfizer were replaced by Salesforce.com and Amgen,” noting that Salesforce doesn’t even pay a dividend. “It has been a wild year indeed,” the article notes, with half of the 2020 Dogs producing negative returns, on average, to the tune of nearly 18%, “while the average gain for the winning stocks is only 4%.”

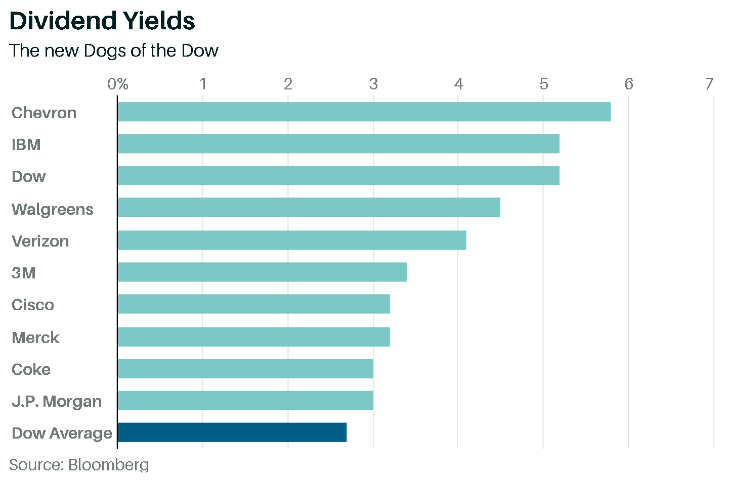

According to the article, several of the names will carry over to this year’s list based on their current yields:

The article notes that even though the case can be made that some of the Dog stocks are poised to rise in 2021, the beauty of the strategy is it “doesn’t require investors to think about individual stocks.” Rather, it “offers a consistent way to rebalance a portfolio and add names that have the potential to rebound.”

Further supporting its argument is the fact that the Dogs strategy outperformed the Dow in seven out of that past 11 years, which makes it an appealing strategy from a peace-of-mind perspective: “something automatic stock allocations can offer.”