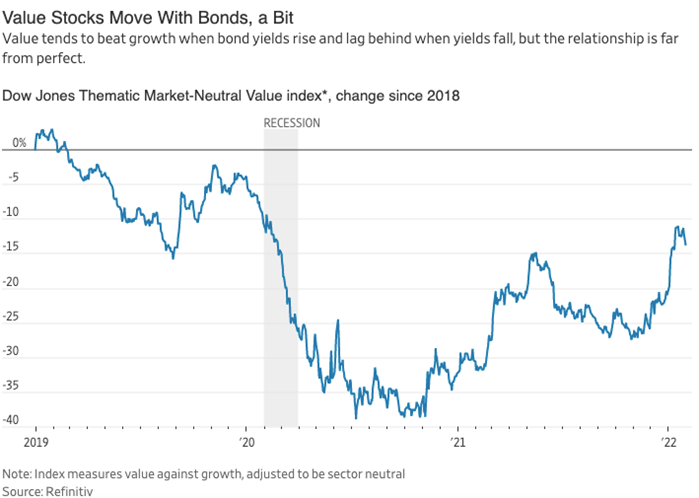

With large value stocks beating out costlier growth stocks by the most of any 50-day period in the last 20 years, value investing is having a moment. But how long will this moment last? asks an article in The Wall Street Journal.

The answer could be found in rising Treasury yields, which have jumped since early December after the Fed took a more hawkish stance to tackle inflation. At the same time, growth stocks tumbled, down nearly 20% from its peak in November. This could indicate that the jump in yields was the straw that broke the camel’s back in growth stocks, giving investors a wake-up call that Big Tech may not always just go up.

That explanation makes a lot of sense for deeply speculative growth stocks, the article contends; costly crypto, clean energy, meme stocks and SPACs have been falling since early 2021, when bond yields were also skyrocketing—a similar scenario as what’s happening now. That shows that the connection between speculative growth stocks and bond yields continues to be very loose, as their price tends to be ruled by sentiment rather than discount rates.

But larger stocks tend to have a narrower focus on the outlook for earnings as well as discount rate, and that could provide another explanation for why growth stocks sold off as bond yields leapt: simple math. Valuations of companies like Microsoft or Apple stay high because their earnings are expected to grow at a high rate in the long-term. Those future earnings are worth more now when the discount rate is lower. When that rate goes up, future earnings go down, the article explains.

The longer the duration of a bond, the more sensitive the price is to fluctuations in the yield. Since value stocks have the lowest duration, they’ve done extremely well, but growth has rebounded as bond yields have pulled back. However, the connection between bond yields and value stocks’ returns isn’t terribly strong; they only moved together about 30% of the time over the past year. If sentiment truly matters, the markets could be shifting towards value, with the math to back it up. But if bond yields really are a major factor, the Fed, geopolitical tensions, and supply disruptions could all cause yields to pull back, and value investing’s moment will disappear.