While the rising yield on the 10-year Treasury is a sign that investors are confident in the U.S. economy, a recent Barron’s article warns, “It’s also a good time to step back and look at the longer end of the yield curve.”

Higher rates can be a “mixed blessing” for investors, the article states. On the one hand, it means that new issues will offer higher yields, but it can “bode ill for existing holdings, especially those at the longer end of the curve, typically with maturities of at least 10 years.” The article cites the example of a recently issue 30-year Treasury bond with a long string of future coupon payments, noting that “higher rates erode the value of those future cash flows in today’s dollars. That’s known as ‘duration risk.'”

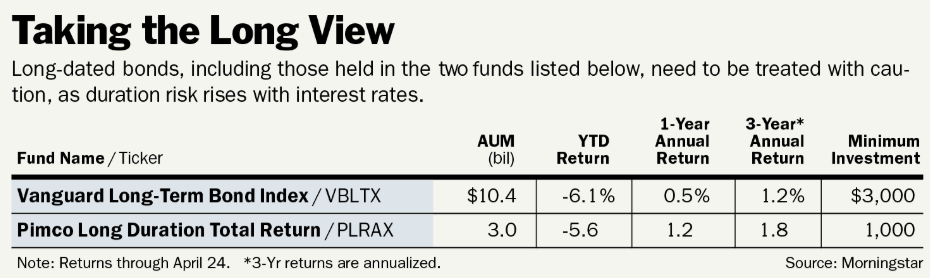

To estimate how big a hit long-term bond investors could take, Barron’s analyzed funds in Morningstar’s long-term bond category:

Miriam Sjoblom, Morningstar’s director of fixed-income manager research, says that such long-term bonds are “just too volatile to be the ballast that most individuals want out of their bond portfolios” and are better suited to institutional investors “looking to offset long-term liabilities with long-term assets.”

Mihir Worah, chief investment officer of asset allocation at Pimco, says, “We don’t see rates going significantly higher from here,” and argues that while long-dated instruments make sense for institutional investors trying to match their long-term liabilities, there is “enough yield and defensive properties” in short-dated bonds. “We don’t like the long-dated sectors,” he says.