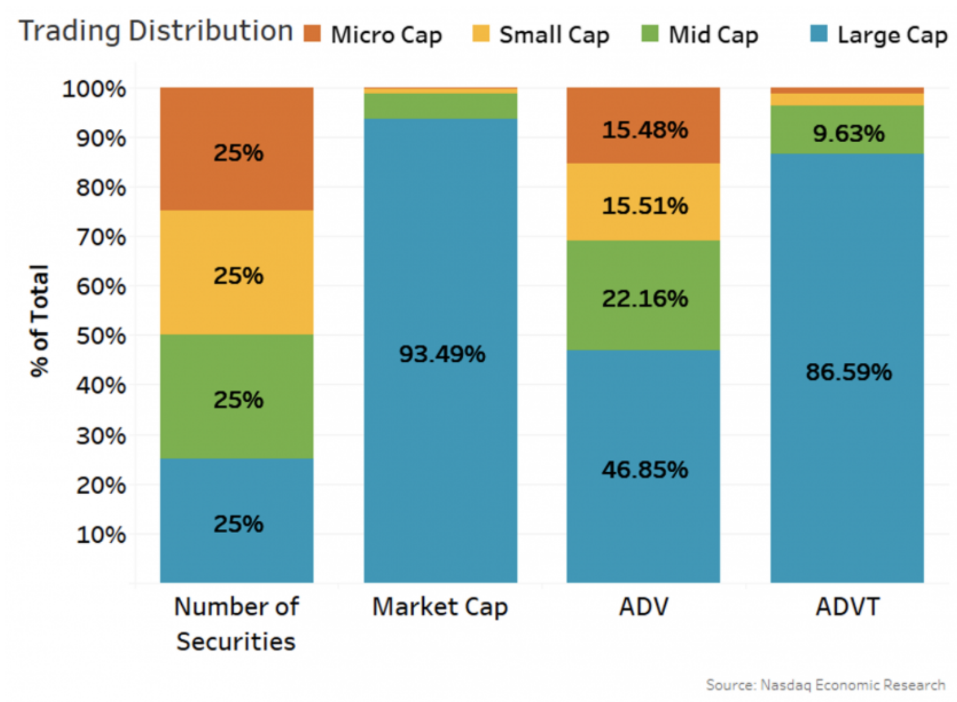

A recent Nasdaq article offers a brief overview of the composition of the U.S. stock market and outlines four ways to look at how large, small and microcap companies contribute to its total market cap and liquidity.

“The U.S. stock market has more than 5,600 listed companies worth more than $58 trillion and has traded almost 11 billion shares or $450 billion in notional value every day so far in 2021,” the article reports, dividing businesses into four categories:

- Number of securities

- Market capitalization

- Average daily volume (ADV)

- Value traded each day (ADVT)

The U.S. market is divided into those categories as illustrated below:

Here are some takeaways from the article:

- Most of the Russell 3000 (a market cap-weighted index of the largest U.S. stocks) fits in the top half of the market (the blue and green sections in the graph), which “leaves a lot of companies that are only included in total market indexes.”

- According to the piece, “Despite their small market cap, the smallest quartile of stocks add to around 15% of average daily volume (ADV). That’s over 1.6 billion shares each day. In contrast, the largest cap stocks make up more than 95% of all market cap, but fewer than half of the nearly 11 billion shares that trade each day.” This is because (1) smaller stocks have lower prices, so “you need to trade more shares to invest the same amount of money,” and (2) retail investors—which have represented a growth segment in the past year– like low-priced stocks.

- The article emphasizes that “shares and liquidity are different things,” noting that retail investing has contributed less to market liquidity than it has to share trading volume, as illustrated by ADVT data in the above graph.

- “Looking at data this way,” the article concludes, “shows how different stocks in our markets are” and underscores that a one-size-fits-all approach doesn’t work well for many U.S. companies. But the diversity of the U.S. market, it notes, is “part of what makes it so attractive to investors.”

Free Report on Systematic Investing

Get a free systematic investing guide, which explains how systematic investing works.

See the stocks part of the S&P 500 and have increased their dividends in each of the past 25 years.