Wall Street still isn’t factoring in the increasingly more dire threat of a recession, and investors cannot rely on the Fed to swoop in and save them this time, contends an article in The Wall Street Journal. Stock prices have been dropping recently because of lower valuations driven by rising rates and Wall Street is still forecasting solid profit growth in 2023. Those are both signs that investors continue to hold out hope for a soft landing, something which even the Fed has indicated is unlikely. As more and more investors get wise to that message, stock prices are bound to fall even further.

As the bear market marches on, the main question becomes how much the risk of recession has already been priced into earnings. Comparing current earnings forecasts to those from before the pandemic, 85% of S&P 500 companies posted higher forecasts earnings per share for the next 12 months than they posted in February 2020, while 81% are trading at lower multiples than their forecasts. That divergence could be due to the effects of the pandemic, when many top tech firms saw their earnings skyrocket, or from the lowered valuation of their future growth thanks to higher interest rates. But the divergence could also be the result of “recession prep,” where the risk to future growth is causing lower valuations, the article posits.

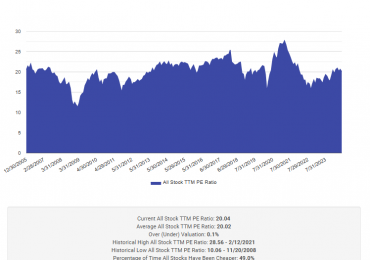

But the tight connection between forward price-to-earnings ratios and real rates actually indicates that stock declines the year were caused by the Fed’s tightening policies, not by earnings being threatened by recession risk. The severe decline in the biggest growth stocks is evidence of that. Meanwhile, the bond markets don’t seem to be preparing for a recession, either; the 3-month Treasury bill hasn’t yet climbed above the 10-year yield, which has been a stalwart indicator of market downturns.

There are still plenty of positives that are preventing Wall Street from pricing in a recession, the article maintains: the strong jobs market, pandemic-era savings that have yet to be used up, as well as the low unemployment rate and record-high wages. Normally, “strong consumers mean a stronger economy,” but with the Fed actively striving to tamp down the job market and stem rising wages, the economy’s current strength means that the Fed needs to work harder to stamp on it. And the market will hold out hope that a recession won’t happen, or be very mild, until the bitter end. Every so often, that works out; more often than not, however, the decline in valuations is just the first sign of a recession that will shred earnings expectations and crush share prices. When that sort of a recession starts to be priced in, it’s probably time to buy.

———————————————

Validea runs stock and ETF models based on investment strategies with proven long-term track records. If you’re new to Validea, consider taking a look at our product overview or introductory videos.