602 special-purpose acquisition companies (SPACs) formed in 2020 have only months to find a deal before they have to give investors back their money, reports an article in Barron’s. The SPACs have a combined $162.4 billion in funds, and because there are so many of them scrambling to find merger targets, it’s likely that many of them won’t.

SPACs raise money in their first public offering on the prospect of merging with a private company. That money stays in a trust collecting interest until the merger is finalized. But if a deal doesn’t happen in a set amount of time (usually 2 years), the SPAC has to return the money to all its investors, the article explains. With so many SPACs in danger of having to do just that, there could be a major shift that could benefit the surviving SPACs who will have to contend with less competition.

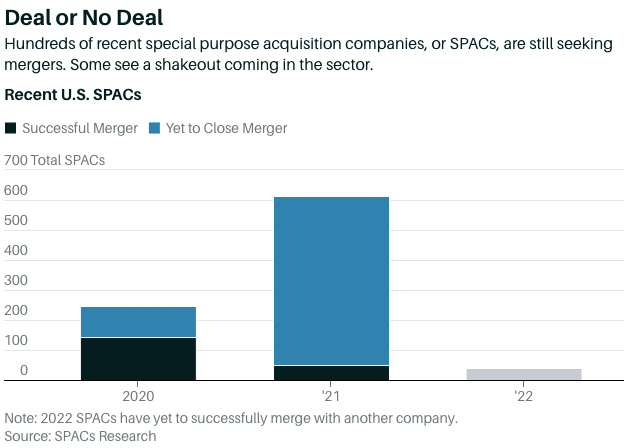

Only 58% of the 247 SPACs founded in 2020 have found and closed acquisitions. That leaves 105 SPACs scrambling to find deals. Of those, 33 have pending deals while 72 are still looking. 2020 was a record year for SPACs, until 2021 blew it out of the water when 613 SPACs began trading. But SPACs have slowed down considerably, with only 41 listed as of February 4th compared to 171 for the same period last year.

SPACs haven’t always done well after going public, however. Pre-deal SPACs used to trade at a premium, but currently 75% of the 2020 SPACs are trading at or below $10 as of the end of February, according to Renaissance Capital data shared in the Barron’s article. That can provide an opportunity for investors. Buying a SPAC even just shy of $10 could boost returns, and investors who already own shares in a SPAC can redeem them for the $10/share value when there’s a vote on a potential merger scheduled. Timing is important: once a SPAC finalizes a merger, investors can’t redeem shares anymore, and the shares start trading like other stocks. So while SPACs are struggling through market volatility and inflation, it can be a good time for investors to jump in and get them on the cheap.