“A compelling argument can be made that 2022 will be a good year for silver,” says Edmund Moy, senior IRA strategist for the U.S. Money Reserve and former director of the U.S. Mint, as demand for the metal has been on the rise around the world, while the price has barely changed over the past 6 months, details an article in Barron’s. The global demand for silver is expected to rise by 8% this year, a record high.

The Silver Institute forecasts growth of 5% this year, calling the outlook “exceptionally promising,” as demand is fueled by a booming industrial demand for the metal by green technologies, as well as electrical and electronic fabricators. That’s about half the total demand for silver; the other half comes from jewelry and investment use, similar to gold.

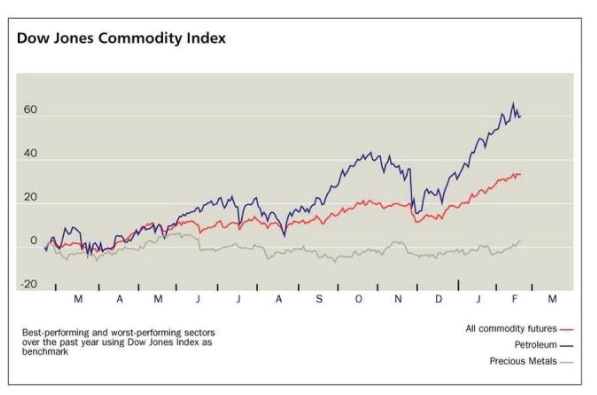

“[S]liver can be thought of as half gold, half copper,” says Robert Minter, director of ETF investment strategy at the asset manager Abrdn. Returns on copper are up 28% since the end of 2020 while gold is down 2% and silver is down 12%. That indicates that the silver prices should be a lot higher. With the prices stuck on the low end, it’s a good time for a long-term investors to buy into either silver or gold, says president and portfolio manager Michael Cuggino of the Permanent Portfolio Family of Funds, especially before a breakout move happens this year, which could be triggered by geopolitical tensions, inflation, and rising demand for the metal. The Silver Institute is predicting the demand in silver to rise as much as 10%, according to Barron’s.

Silver is already becoming popular with investors. The pre-pandemic sales level of American Eagle silver one-once coins at the U.S. Mint was 14.9 million, and it shot up to 28.3 million in 2021. Silver mining stocks and ETFs can also be a smart addition for a portion of a portfolio, and a good hedge against inflation, though Moy says that “their performance is dependent on more than just spot prices,” and advises owning the physical metal as it gives investors a tangible asset without having to deal with management—though of course storing it and transporting it are major concerns to factor into a silver purchase, the article concludes.