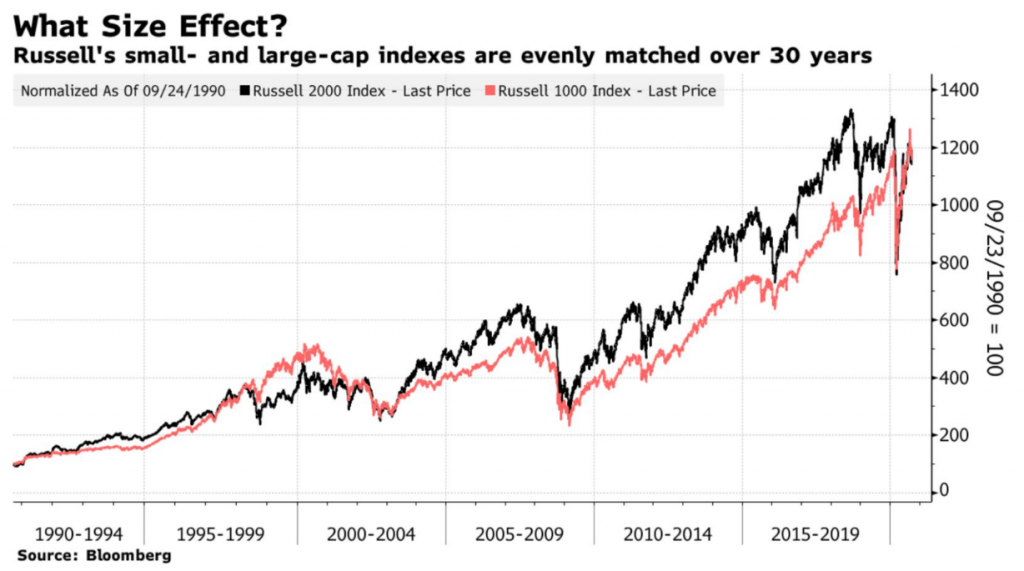

While some young academics are trying to increase the list of investment factors, “grizzled veterans are concluding that the small-company effect does not, after all, exist.” This according to a recent article in Bloomberg.

“Over the last few decades,” the article reports, “there is little clear small-company dominance,” noting that while the outperformance of tech has helped this, the factor is “muted at best. Smaller companies tend to do a little better during good times, only to give back all of their advantage in market breaks.”

The article reports that small caps perform well when the market is doing well and, similarly, perform poorly when the market is down. But this level of sensitivity, then, indicates that “there is no specific small-company effect.” These findings are echoed by Cliff Asness and his team at AQR, who argue that the small-company effect never really existed in the first place: The team asserts that even a few decades ago, “the apparent outperformance of small companies over and above their beta was only because their beta had been underestimated, due to their illiquidity.” Once you account for this “lag”, Asness writes, “you really don’t find any size effect. Zippo. Nada.”