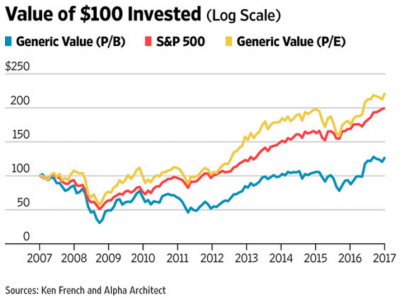

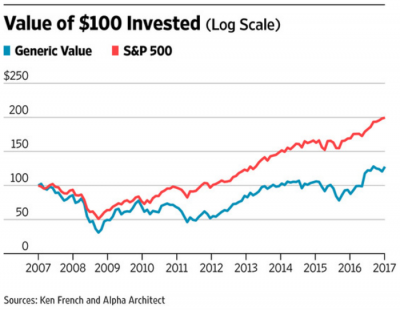

If you gauge value investing by evaluating “a portfolio that buys cheap stocks based on price-to-book ratios,” it hasn’t done too well over the past decade, according to a recent article in The Wall Street Journal written by Wes Gray, CEO and CIO of Alpha Architect, a quantitative asset manager based near Philadelphia.

The article offers the example in which a “generic portfolio of the cheapest stocks (labeled ‘Generic Value (P/B)’ based on price-book ratios earned a compound annual total return of 2.44%, compared with the S&P 500’s total return of 7.10%.” It explains, however, that price-to-book is only one factor to consider and that, over the same ten-year period, the use of price-earnings ratios has been more effective.

“To be sure,” says WSJ, “value investing based on alternative metrics hasn’t exactly knocked the cover off the ball, but it has certainly kept pace with the general market, albeit via a bumpier road (volatility on the P/E value portfolio was higher than the S&P 500).” And while there is still debate about whether the margin between P/B and P/E value stocks are due to higher risk or mispricing, the article asserts that it’s probably a combination of the two. “Value stocks,” it says, “earn higher expected returns because they are riskier: These companies often operate in highly competitive industries or industries that are engaged in disruption (e.g., retailers facing Amazon).”