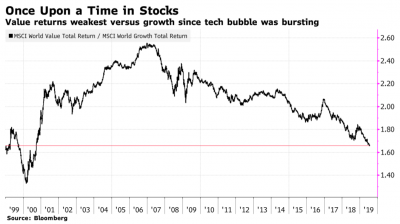

A recent note from strategists at JPMorgan Chase says that we are seeing “the largest relative valuation bubble in modern equity market history,” with value stocks trading at the most depressed levels compared to growth stocks in almost twenty years. This according to an article in Bloomberg.

The article notes that when value stocks dropped to similar levels in 2000, “they went on to surge more than 50% against their opposing cohort in the next 12 months.” In their note, the JPMorgan strategists characterized the current environment as a “once-in-a-decade opportunity” to bet on the factor, asserting that steadier economic data, advances in trade talks and a rising yield curve could lay a foundation for a value comeback.

But the article also offers a “less-rosy” outlook: “Structurally,” it says, “there’s a growing suspicion the value factor may be broken.” It explains that rapid technological advances have turned traditional sectors like financials and industrials in to “permanent laggards” and that the Fed’s return to rate cutting as well as slow economic growth “bode ill” for economically sensitive shares (citing car makers and banks as examples).

Another theory, the article notes, is that the definition of value needs to be adjusted: “As intangible assets from patents to human capital become increasingly critical to corporate success, it makes no sense to use book value in multiples, as the common definitions of the factor often do.”