By Jack Forehand (@practicalquant) —

It has become a common belief in the investing community that passive investing is superior to active management.

And there is a large volume of data that supports that argument.

Over time, active managers have not produced sufficient returns to justify their fees. In aggregate, finance theory tells us that active managers as a whole will produce the same gross return as the market over the long-term, and their underperformance on a net basis will equal the difference between active and passive fees.

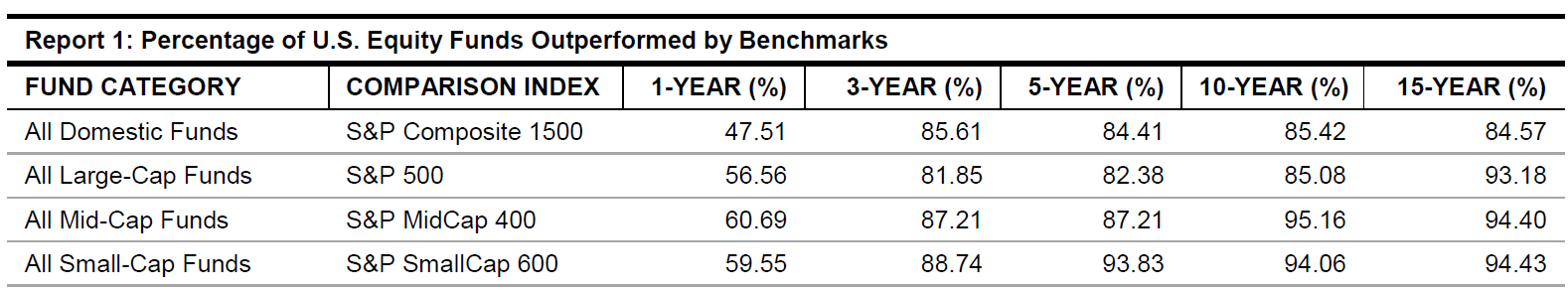

In essence, active managers are playing a game they are guaranteed to lose. And the results back that up, with upwards of 80% of active managers underperforming their benchmarks long-term. Using the S&P SPIVA scorecard data, we can see that over the last fifteen years only 15% of managers have outperformed their respective benchmark. The data is even more lopsided toward passive investing when you look at small- and large-cap managers relative to their benchmarks.

Source: SPIVA Scorecard data from S&P. Data as of June 30th, 2017.

But what about the managers that do beat the market? Can’t you just invest with them?

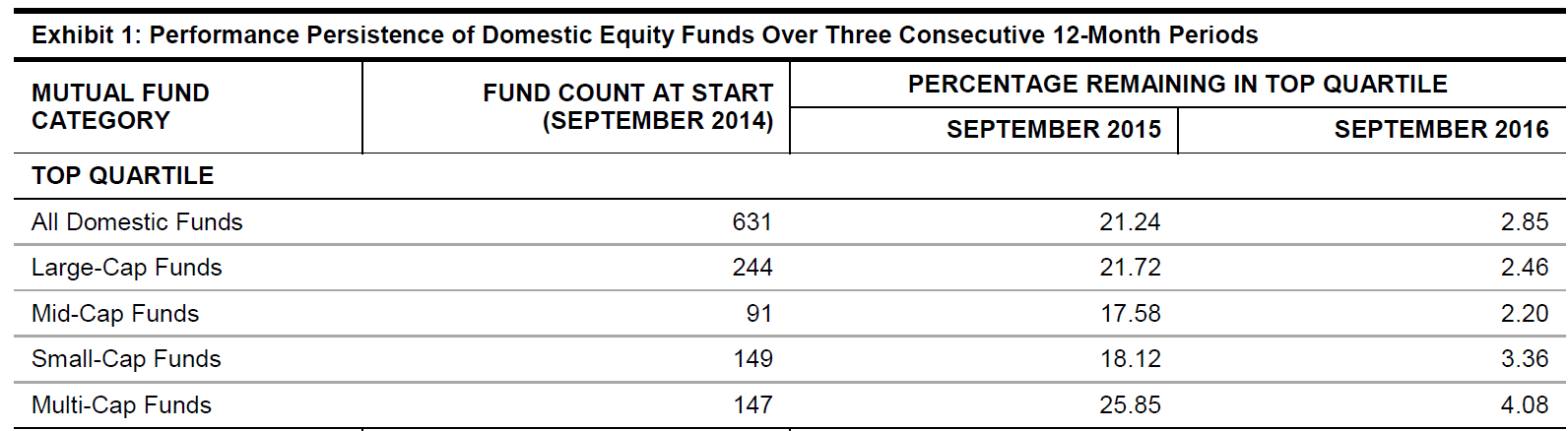

It turns out that is nearly impossible because the managers that outperform in one period tend to not outperform in the next period. When studies have looked at the performance of funds that receive a 5-star rating on Morningstar, they have found no evidence that they beat other managers going forward. As the disclaimer we all see all the time says, past results are not indicative of future performance. The table below uses more S&P SPIVA research to drive this point home. In September 2014, there were 631 top quartile equity funds according to S&P. Fast forward two years to September 2016, and only 2.85% (or 18 funds) stayed in the top quartile.

Source: S&P Dow Jones, “Does Past Performance Matter? The Persistence Scorecard“

When you examine investor returns, the case for passive funds gets even stronger. Investor returns are the returns investors in the funds actually achieve. They include the effects of investor behavior, unlike standard returns. When it comes to investor returns, index funds face one major point of failure (that investors will sell when the market is down), but active funds face two (that investors will sell when the market is down and when the fund underperforms its benchmark). That additional point of failure leads to less desirable investor behavior in active funds. As a result, the difference between an active fund’s actual performance and the performance of its investors is typically greater than for an index fund.

Due to all these factors, the case against active management seems pretty clear cut.

But very few things in investing are truly clear cut, and this is no exception.

The Opportunity Cost of Passive Investing

The rise of factor investing introduces significant changes to the active vs. passive debate. The reason is that factor-based strategies have two things going for them that other active strategies do not. First, decades of data shows that they produce outperformance over market indices. And second, they follow rules-based approaches that eliminate emotion from the investing process. Factor strategies take the guesswork out of determining whether a particular manager’s track record is the result of luck or skill because they follow a consistent, repeatable process. They also eliminate the risk that a manager who has succeeded with one strategy will change that strategy going forward.

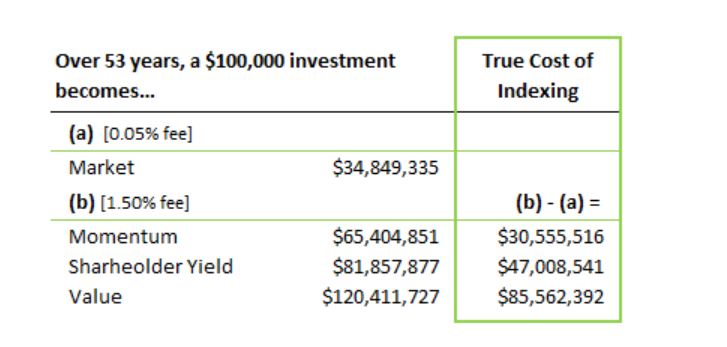

There was a great article on the Factor Investing blog that drove home the potential for factor-based active strategies. Although costs are typically cited as a significant negative for active strategies, a different type of cost can be an issue for passive approaches – the opportunity cost of not investing in a superior active portfolio.

As the article points out, factor-based portfolios built using factors like Value, Momentum, or Shareholder Yield have beaten the market by between 2% and 4% per year over the long-term. Even if you apply a very high level of fees to one of these portfolios, you still get substantial outperformance over an index fund over time.

Take a look at this chart from the article. Even at a 1.5% fee level for the factor portfolios (which is much higher than you will need to pay in the real world), the active factor portfolios outperform the index fund by a wide margin.

The true cost of indexing becomes the return you give up by not investing in other factors that outperform the market cap weighting of the index fund. That cost can be astronomical over time.

The Battle Between Behavior and Returns

Looking at those return differentials puts the active and passive debate in a whole new perspective. It can easily make you think the experts have had it all wrong and active investing is the superior strategy. But despite the huge return difference, it is still true that the vast majority of investors should invest passively.

How is that possible? No rational investor would give up significant excess return over the long-term, would they?

The answer is yes, they would. And the reason is that the vast majority of investors as not capable of sticking with those active portfolios in order to achieve the superior returns. Behind those amazing returns are extended periods, which can be years long, where those strategies trailed the market, sometimes by wide margins. All but the most disciplined investors would have abandoned those strategies during the periods of underperformance. And it turns out that those are the exact wrong times to do it because extended periods of underperformance are typically followed by extended periods of outperformance. So the reason that investors would be completely rational to invest in passive vehicles and give up those active returns is that they would have little chance to actually achieve them.

This is why there is no answer to the active vs. passive debate. For the majority of investors who cannot stomach extended periods of underperformance, passive strategies make the most sense. But for the rare investor who can truly set their strategy and forget it, the evidence strongly favors approaches that build portfolios based on factors that have outperformed market-cap weighted portfolios over time. It turns out that the proponents of passive investing and its detractors can both be right simultaneously, because the answer for each investor is different. The most important thing is being honest up front about where you fall on the behavioral spectrum and how you will react when things get bad. Investors who can do that are likely achieve their investing goals, regardless of whether they choose active or passive.

Jack Forehand is Co-Founder and President at Validea Capital. He is also a partner at Validea.com and co-authored “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Jack holds the Chartered Financial Analyst designation from the CFA Institute. Follow him on Twitter at @practicalquant.