GameStop, the struggling video game retailer that led the meme stock frenzy in 2021, saw its shares skyrocket once again this week before falling back to earth. The big move was caused by the surprise return of Keith Gill, the trader known as “Roaring Kitty” who helped ignite the original GameStop mania, to social media after a three-year hiatus (although some suspect it isn’t Gill who has been actually sending the tweets)

Roaring Kitty’s Return Reignites Frenzy

On Monday, Gill posted a meme on Twitter depicting a gamer leaning forward in a red chair with a red arrow. GameStop shares immediately doubled and many believed that meme stock mania was back.

Trading in GameStop was halted multiple times due to volatility and other meme stocks like AMC Entertainment and Bed Bath & Beyond also saw their shares rise dramatically. However, the fervor quickly died down, with GameStop tumbling by Friday after the company announced plans to sell up to 45 million additional shares and warned on financial results.

A Surge Not Backed Up by Fundamentals

While the renewed interest from retail traders caused GameStop’s market value to briefly balloon to nearly $20 billion, a deep dive into the company’s fundamentals using Validea’s guru models suggests the business remains on very shaky ground.

The most positive assessment comes from the Kenneth Fisher-based Price/Sales Investor model, which gives GameStop a 60% score, noting its low P/S ratio of 1.29 and minimal debt. However, the company falls short of Fisher’s other criteria for a true growth stock, like strong long-term EPS growth and high profit margins.

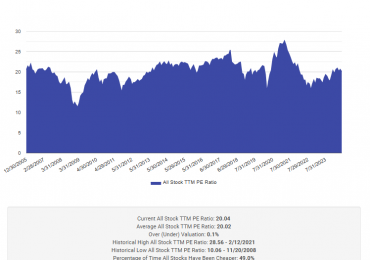

Validea’s Benjamin Graham-inspired Value Investor model, focused on finding undervalued companies with a margin of safety, scores GameStop at just 57%. While it meets Graham’s standards for size and financial strength with $5.3 billion in sales and a current ratio over 2, the model has major concerns with GameStop’s sky-high P/E ratio of 1,060 and lofty P/B ratio over 5. It also notes the company’s inconsistent earnings, with EPS dipping into the red in recent years.

The Growth/Value Investor model based on James O’Shaughnessy’s approach gives GameStop a middling 50% score. It likes the company’s ample market cap and reasonable price/sales ratio but is alarmed by GameStop’s lack of persistent earnings growth in recent years.

Meanwhile, GameStop scores a weak 43% on the David Dreman-inspired Contrarian Investor model, which seeks out-of-favor stocks. While GameStop exhibits a positive earnings trend, its extreme valuation ratios, with both P/E and P/CF ratios far above the market’s bottom quintile, suggest it’s no longer a true contrarian play. The model does like GameStop’s low debt/equity ratio, but notes other red flags like subpar margins and return on equity.

Perhaps most concerning are GameStop’s dismal scores on Validea’s growth-focused models. It achieves no better than a 38% rating on any of these strategies, which look for companies delivering consistent profit growth and investing for the future.

The Partha Mohanram-based P/B Growth Investor model, for example, likes GameStop’s solid return on assets and cash flows. But it’s troubled by the lack of investment in growth drivers like R&D, capital expenditures and advertising.

Similarly, the Motley Fool-inspired Small-Cap Growth Investor methodology gives GameStop just a 28% score. It sees potential in the company’s ample cash compared to debt but is concerned by contracting margins and the lack of positive and accelerating earnings and sales growth.

A Shaky Long Term Picture

While GameStop’s latest roller coaster ride generated excitement among meme stock enthusiasts, its shaky fundamentals make it a risky bet for long-term investors. The company faces major challenges as video game sales shift online and gamers increasingly download new titles instead of buying physical copies.

GameStop’s latest earnings report underscored those headwinds, with the company projecting a substantial drop in sales for the current quarter. And while it expects to reduce losses through cost-cutting, there are questions about its long-term strategy.

The GameStop saga demonstrates the power of social media to generate short-term trading frenzies. But it also highlights the dangers of ignoring fundamentals. For prudent investors, Validea’s guru analysis suggests looking elsewhere for opportunities in companies with more sustainable growth prospects and financial strength.

Research Links