There is a flurry of debate over the Dodd-Frank Wall Street Reform and Consumer Protection Act (commonly referred to a Dodd-Frank), the negative impact it has had on small, regional financials and if/how it will be repealed. In this week’s Forbes, Validea CEO John Reese gives an overview of the law and the issues surrounding it, and identifies five financials that could benefit from its repeal.

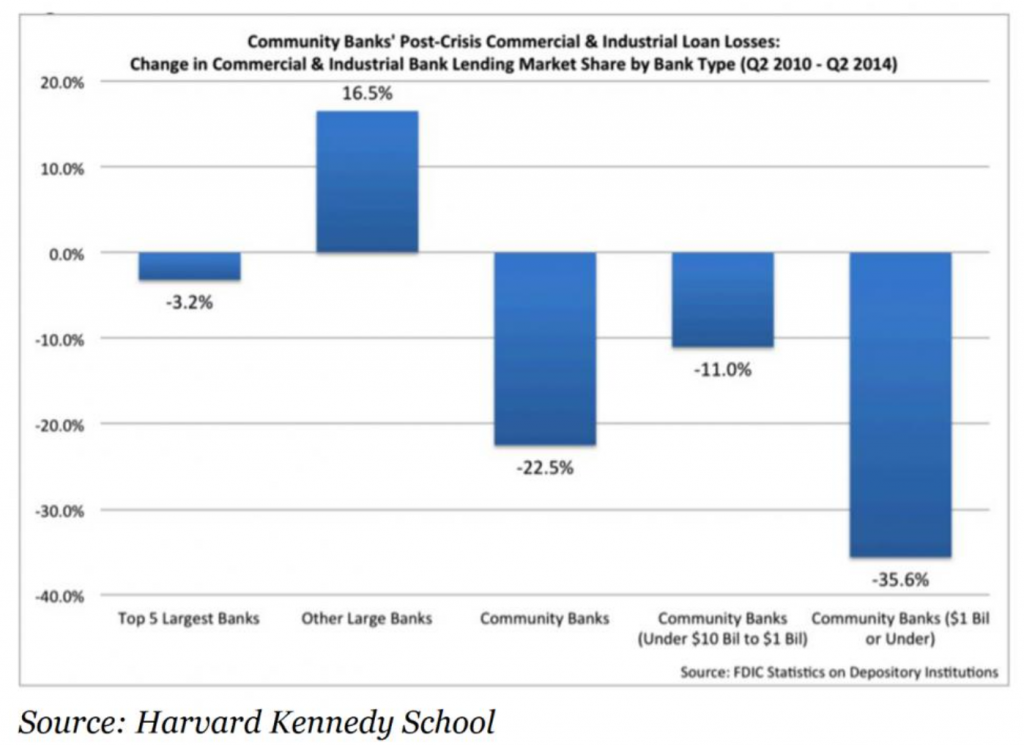

Reese explains that the complex regulations Dodd-Frank has imposed on financials has led to a significant loss of market share for community banks:

He writes, “It depends on who you ask, but it’s safe to say that President-elect Trump will push hard for regulatory reform in an effort to jump-start economic growth. To that end, Dodd-Frank will be under the microscope as the new administration gets underway.”

Here are five smaller financials that could benefit from decreased regulation, says Reese:

- Franklin Financial Network (FSB) provides a range of banking and related financial services in the Nashville area, and earns high marks for its ratio of revenue growth to earnings-per-share growth (PEG ratio) as well as its equity-assets ratio.

- Pennymac Financial Services (PFSI) is focused on the production and servicing of residential mortgage loans and scores highly for its PEG ratio and revenue growth.

- Farmers Capital Bank (FFKT), which provides a range of banking and related services to customers throughout Central and Northern Kentucky, scores well due to its earnings-per-share growth and equity-assets ratio.

- Tristate Capital Holdings (TSC), a provider of commercial and private banking services, gets a thumbs up based on quarter-over-quarter sales growth and persistent increases in earnings-per-share.

- Trico Bancshares (TCBK) is engaged in general commercial banking business operations in Northern and Central California, and scores highly based on its ratio of equity-to-assets, price-earnings ratio, and growth in earnings-per-share.