By John Reese (@guruinvestor) —

Over the past twelve months, we’ve seen the bull market continue to trudge ahead with highs in many U.S. indexes and growth in various sectors and industries. With the news of major tax reform comes optimism for continued corporate earnings strength. That said, however, there are also growing concerns regarding an overvalued market and a potential correction.

Let’s review what we’ve learned over the past twelve months:

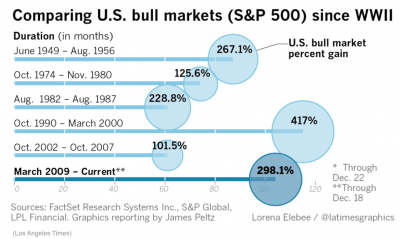

Bull markets don’t die of old age. This ubiquitous adage reminds us that a bull run won’t fizzle out unless there is a catalyst to trigger a shift into bear market territory–such as a tightening of monetary policy, a recession, or irrational exuberance on the part of investors–none of which seems to be on the horizon now. Positive economic factors have bolstered corporate earnings, which have in turn fueled stock performance. And while this could continue as the newly-passed tax reform takes hold, there are some shocks that could derail the momentum; the Fed could act more aggressively than it has signaled, for example, or there could be a disruptive geopolitical event.

source: http://www.latimes.com/business/la-fi-stock-market-year-review-20171224-story.html

Having Non-U.S. Exposure is Important. Diversification is a good idea for any investment portfolio, and the global recovery we’re seeing underway means there are opportunities for investors in the overseas markets. Some of the market’s Europe-centered fears, for example, ended in a soft landing; i.e. the French presidential election results squelched concerns regarding a potential eurozone breakup, Brexit seems to have had more bark than bite, and the Eurozone has seen some of the fastest growth since March 2011. A weakening dollar could help commodity- and industry-based emerging market economies.

source: https://www.yardeni.com/pub/peacockglstkytd.pdf

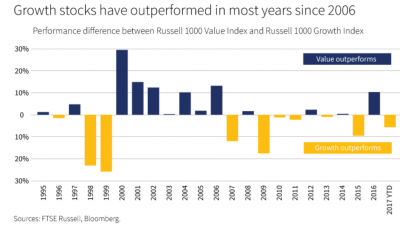

Value investing can be tough, and reversion to the mean doesn’t turn on a dime. Although value shares have recently outperformed growth, the trend is believed by some to be fleeting and not a direct result of optimism regarding tax reform. In his bestselling 2005 book, The Little Book That Beats the Market, value investing guru Joel Greenblatt (who served as the inspiration behind one of the stock screening models we use at Validea) showed readers how to identify good companies selling for bargain prices using a “Magic Formula” of only two criteria–return-on-capital and earnings yield. While Greenblatt’s formula is straightforward, however, it doesn’t eliminate psychological barriers to investing success—that is, that many investors run for the hills when returns dip. Greenblatt believes that if subscribers to his formula truly understand why it makes sense, they stand a greater chance of sticking with it and reaping the benefits. In an interview with Forbes earlier this year, Greenblatt said, ” The market is not always cooperative in the short term, and the key when it’s not being cooperative is to be patient. Right now, patience is in short supply. You used to get a quarterly statement and throw it in the garbage; now you can check your stock price thirty times a minute. Time horizons are shortening, and the payoff for patience is getting better.”

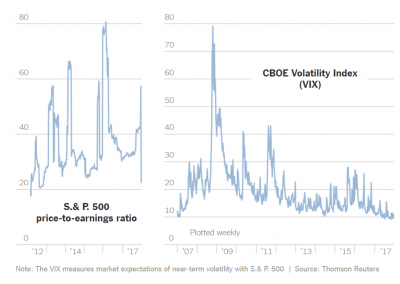

Volatility, usually associated with downside, is not always a bad thing. Volatility has been low this year due to a combination of factors including investor sentiment, monetary policy, a late-stage business cycle, and low correlations (stocks are not moving in tandem). As recessionary risks continue to appear remote, volatility is likely to remain subdued. But volatility can also represent upside for the patient investor who is able to weather stock market storms. Higher returns, for example, can be a reward for investing in riskier, more volatile assets. Solid businesses may experience short periods of undervalued shared prices, and this kind of volatility allows investors to enter the market and exploit the opportunity. So, during downward swings in volatility (which we have seen this year), establishing and adhering to a long-term investment plan can serve as protection against future share price swings.

source: https://www.nytimes.com/interactive/2017/12/31/business/A-Big-Year-for-the-Stock-Market.html

These are only a few of the prominent investment takeaways from 2017, which has been an interesting year on many fronts. What’s the common denominator for the investor? Determining the investment approach that best fits your needs and sticking to it, no matter what the direction the market takes.

——-

John Reese is founder and CEO of Validea.com and Validea Capital Management, LLC. Validea is a quantitative investment research firm and Validea Capital, a separate company from Validea.com, which maintains this blog, is a asset management firm offering private account management, ETFs and a robo advisor, Validea Legends and Validea Legends Income. John is a graduate of MIT and Harvard Business school, holder of two US patents and author of the book, “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Follow John on Twitter @guruinvestor.

John Reese is founder and CEO of Validea.com and Validea Capital Management, LLC. Validea is a quantitative investment research firm and Validea Capital, a separate company from Validea.com, which maintains this blog, is a asset management firm offering private account management, ETFs and a robo advisor, Validea Legends and Validea Legends Income. John is a graduate of MIT and Harvard Business school, holder of two US patents and author of the book, “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies”. Follow John on Twitter @guruinvestor.