After its steep plummet at the beginning of the year, the stock market rally last month seemed like cold comfort, and it continues to wobble up and down without much…

Tag: Market Volatility

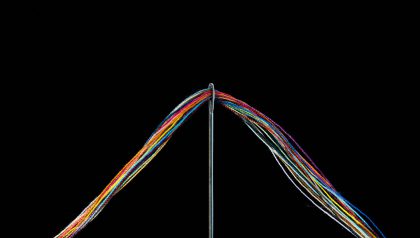

The Era of Low Volatility Is Over

Jerome Powell’s speech at the Jackson Hole conference last month garnered a lot of attention, but perhaps more should be paid to Agustin Carstens’ speech instead, contends an article in…

What Investors Need to Know About the Impact of Options on the Stock Market with Brent Kochuba

Many investors think that options are just a vehicle that affects the portfolios of sophisticated investors. But their impact on the market goes well beyond that. In this episode, we…

Gamma, Vanna, Charm and the Impact of Options on the Stock Market with Jason DeLorenzo

While many investors are likely familiar with options, their impact on the stock market is much less understood. When an investor buys an option, it can kick off a series…

The Market’s Turmoil Is The Ultimate Test Of Reality

With the S&P 500 index down 10% below its last high, the Nasdaq-100 index off almost 15% from its November peak, and the Russell 2000 Index of smaller companies down…

Expect A More Volatile Environment In 2022

In an excerpt from Canaccord Genuity’s December Strategy Picture Book in Proactive Advisor Magazine, U.S. portfolio strategist Tony Dwyer writes that they expect 2022 to be a “volatile trading range…

Andrew Thrasher Schools Two Value Guys on Technical Analysis and Forecasting Volatility Tsunamis

In this episode we take a deep dive into technical analysis with Andrew Thrasher, founder of Thrasher Analytics and portfolio manager at the Financial Enhancement Group. We look at the…

Strategies for When Stocks Drop

Although US stocks appear poised for continued growth, “risks remain and a market decline can be just around the corner, threatening to unnerve investors at any time,” according to a…

Interview: Liquidity Cascades with Corey Hoffstein (Ep. 45)

It has been said that the most dangerous words in investing are “this time is different”. But sometimes a confluence of factors come together to significantly change the character of…

Survey Says Negative Returns Expected by 41% of Retail Investors

A recent survey of U.S. investors reflects a climate of “confusion and disconnect,” with retail investors feeling “both bullish and bearish about the future of the stock market and whether…