Morningstar data shows that, in February, actively managed mutual funds posted their first month of positive net inflows since April 2015, according to an article in The Wall Street Journal.

There is optimism among investors, the article says, that “conditions are right for active managers’ resurgence to continue, eventually slowing the flow of money out of actively managed funds into lower-cost index-tracking funds, a trend that hounded many of them in recent years.” While investors continue to withdraw money from actively managed funds, says WSJ, they pulled out less in February than in any month since September 2015.

The last several years have been tough for active managers, the article says, noting a comment by Dan Chung, chief executive and chief investment officer at Fred Alger Management, that growth managers had a particularly tough time. Chung says, “Confidence was due to come back.”

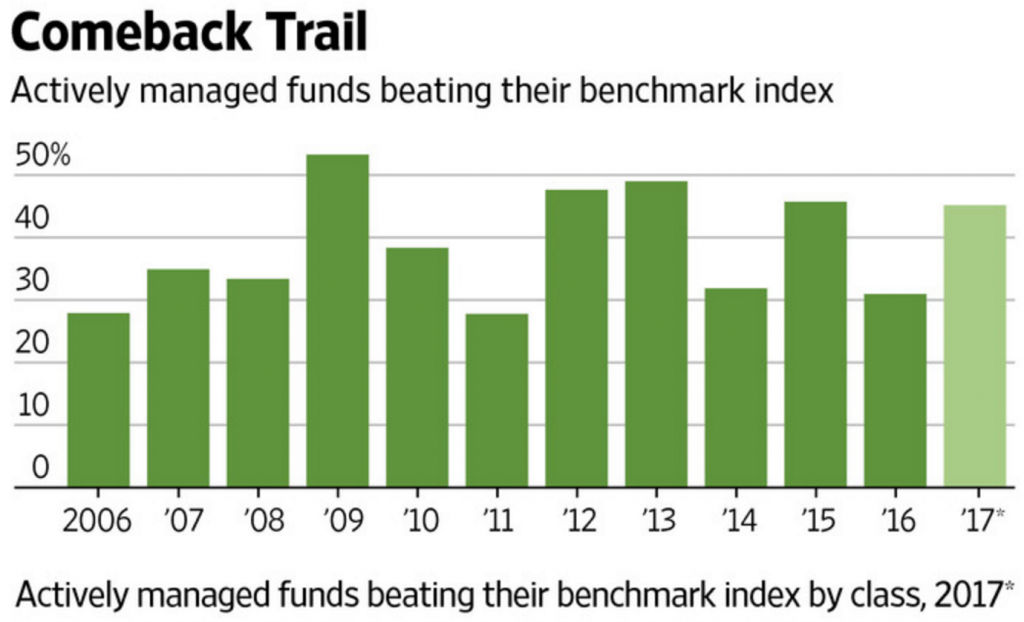

Those funds that pick stocks in a specific industry have led the recent gains, the article says, with “more than half ahead of their benchmarks.” For a group that has had trouble beating benchmarks in recent years, this is welcome news. Rob Sharps, co-head of global equity at T. Rowe Price Group Inc., attributes the improvement to interest rate hikes by the Fed, the Trump administration agenda and a decreased correlation among assets classes.

But some active fund managers, the article argues, “continue to overhaul their product lineups, fees and business units in a bid to adapt to the continuing competitive pressure.” These include BlackRock Inc., which is placing greater focus on quantitative investing and fee cuts (as well as active manager layoffs).