In last week’s piece, link here, I discussed what Peter Lynch might say to the millions of investors who have been investing in individual stocks over the last few months.

First the backdrop – online brokerage accounts at Robinhood, E*Trade and others have skyrocketed higher. For instance, in March alone, E*Trade announced over 200,000 new accounts – more accounts in one month than in any full year on record. And then there is is Robinhood, booking more than 4.3 million daily average revenue trades (DART) trades a day in June of 2020 alone – more than TD Ameritrade, Interactive Brokers, Charles Schwab and others. As the title of this Wall Street Journal Piece points out, “Everyone’s a Day Trader Now”, there’s rabid demand for buying individual stocks, particularly from younger investors who are actively trading in and out of some of the markets most popular stocks – and doing well I might add.

Many of these investors are buying stocks for the first time. Over time, some will graduate to long-term investors. In this two part series, I have attempted to capture some of the knowledge and wisdom espoused by Peter Lynch, a master stock picker, and develop a set of rules and principles that these new stock investors can learn and grow from.

To start, we can review the first three important concepts Lynch may identify with from my first article.

#1: Sixth Grade Math & Fundamentals

#2: Don’t Confuse Luck with Skill

#3: Avoid Cutting Your Flowers and Watering Your Weeds

In this article, we can move on to the last three important points that I believe Lynch would agree with.

#4: Can You Explain It To Your Mother?

Lynch strongly advocated investors know the narrative around a company when they are buying a stock. Lynch said:

“Everybody that’s buying individual stocks has to understand the story … [have] five reasons why something’s going to go right.”

A good litmus test for this is can you explain the company and your investment thesis to your mom in less than 90 seconds on a Sunday night call. If the answer is no, then you probably shouldn’t be invested in the stock to begin with.

Here are a few things to understand before you put money to work in an individual name:

- What is the company’s main business;

- How does the company make money;

- What are the company’s competitive advantages and who are its competitors;

- What are the main growth drivers;

- What are the risks to this business.

#5: Understand That Stocks Are Not Lottery Tickets

Lynch once said:

“Stocks aren’t lottery tickets. Behind every stock is a company. If the company does well, over time the stocks do well.”

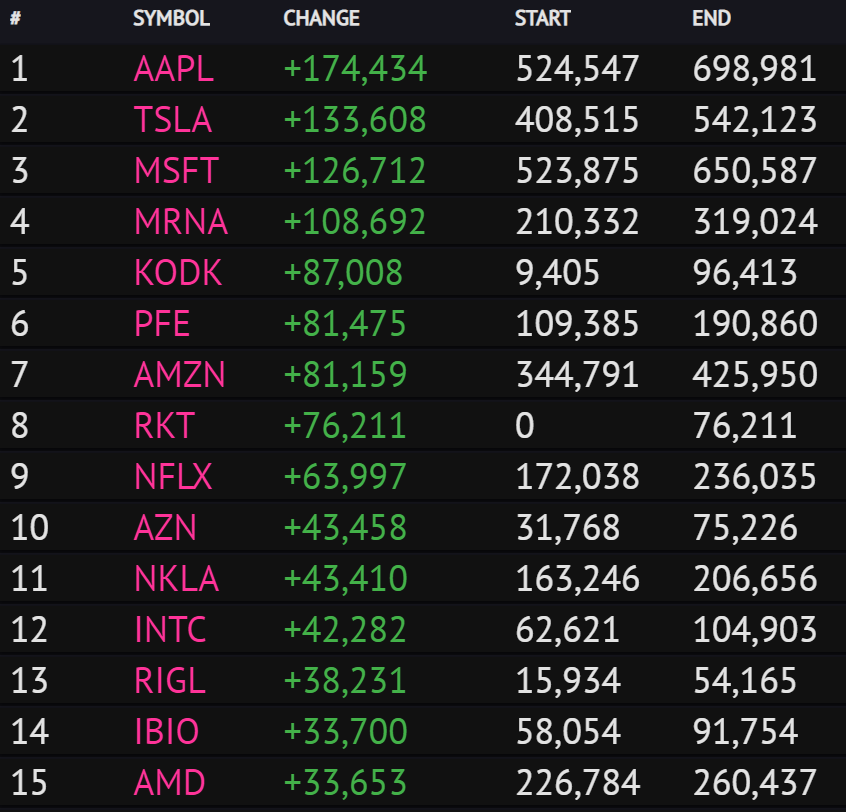

The chart below tracks the stocks that have increased the most in terms of being added to new investor accounts in Robinhood over the last 30 days as of the writing of this article (Aug. 4th, 2020). On the list, some of the names either don’t make money or are trading at valuations that are hundreds of times their earnings (often a sign of extreme overvaluation). It’s not to say these stocks won’t go on to be great stocks, but popular stocks don’t always make good long-term investments. When you hear stories like 40,000 investors add Tesla to their accounts in one day, you can’t help but think many of these starting investors are just buying because everyone else is, not because they believe in Elon Musk and Tesla’s business model.

Source: https://robintrack.net/popularity_changes

(note the API to Robinhood was shut down – this may be the last snapshot of the most popular trending stocks over the last 30 days on Robinhood as of August 4, 2020).

#6: Remember, Nothing is Really Free

Lynch has never commented on this specifically, but given his reasonable line of thinking on investing, I would imagine he would tell you there are no free lunches in life and in investing, so don’t think that Robinhood or any other commission free brokerage platform, which is offering “free” trading, is doing it out of the kindness of their hearts.

Robinhood set in motion a sea change in the online brokerage business. Free trading, or $0 commissions, are now the standard in the industry, as all the major platforms – Schwab, Interactive Brokers, E*Trade and even Peter Lynch’s alma mater, Fidelity, offer commission free trading. But that doesn’t mean free is really free. Payment for order flow, which brokers receive for routing trades to certain market makers who make money on the spread between the bid and ask between stocks, as well as account service fees, fees on margin, paying below market rates on cash, and other fees contribute to the various ways a broker makes money. It’s important to remember that very few things in life are actually free.

Lynch’s Durable, Time-Tested Advice Now and In The Future

Ultimately, I think Peter Lynch would say “congratulations”, you’ve taken the first step in investing in the markets. Buying individual stocks is one of the most powerful ways to grow your wealth over time. But in order to get the most out of what stocks can offer, Lynch would say, I believe, just as he did some 30 years ago and as recently as December of last year – “buy what you know”, look at the fundamentals, take a long-term view and don’t let market declines scare you out of stocks. And know the story behind the names you own.

To this day, Lynch still believes individual investors still can have an edge in the markets, and many of these young investors may be able to develop their stock picking skills over time by learning from their successes and failures. And listening to Lynch’s advice is a great way to start that process.

Justin J. Carbonneau is VP at Validea & Partner at Validea Capital Management.

Social | Podcast | Interviews | Articles

about Justin all in one place